Financing Options for Purchasing Pre-Construction Condos in Toronto

If you’re exploring the purchase of a pre-construction condo in Toronto, it’s important to understand your financing options. Financing for pre-construction homes or condos is a little different than financing for a resale home or condo. That’s because unlike with resale, you’re not getting a mortgage or paying your full deposit right away. With a pre-construction purchase, you’re typically paying the deposit over time, during the construction period, with a deposit payment schedule. Mortgage financing usually kicks in at final closing, not at the time of purchase. You may need to provide a mortgage pre-approval when signing your agreement, and then formally qualify again when the condo is ready at final closing.

Read on to learn more!

Quick Recap: The Benefits of Buying Pre-Construction

As we’ve covered in previous blog posts, pre-construction condos offer many benefits. These include customization options, modern design, and better potential rental income. They can also be a better investment compared to resale. New development condos purchased at the pre-construction phase offer the opportunity to secure the lowest possible price, flexibility in the financing, and other perks that increase their value, like top-notch amenities, fewer repairs and maintenance, and more.

Buying a pre-construction condo in Toronto can also offer a more flexible and approachable down payment structure.

Understanding the Deposit Structure

Most Toronto pre-construction projects require a deposit of between 15% and 25%. This may seem like a lot, but the amounts are broken up and spread out over several months or even years.

Here’s what that deposit schedule might look like, as an example:

$5,000 deposit due on signing

5% due within 30 days of the offer

5% due within 90 days

5% due within 180 days

5% due at the time of occupancy

In some cases, especially for investors or first-time buyers, builders may offer limited flexibility or extended deposit structures. Some new home builders and condo developers also offer deposit loan programs or incentives. Home buyers and investors often use a line of credit or savings to cover deposit payments.

By contrast, when purchasing a resale home or condo, a deposit of around 5% is typically required to secure a property. Once the offer is accepted, buyers must pay their full down payment upfront. In Canada, the minimum down payment required to finance a home with a mortgage is 5%, but many people aim to put down at least 20% in order to secure a better mortgage (and a 20% down payment is a requirement for homes valued at $1.5 million or more). Down payments of less than 20% mean that your mortgage may be classified as high-ratio, which typically means that mortgage default insurance from the Canada Mortgage and Housing Corporation (CMHC) is required in order to protect the lender from the risk of borrower default.

Mortgage Pre-Approval

When buying a pre-construction condo in Toronto, even though you won’t need the mortgage for a few years (when the condo is fully constructed and ready for move-in), a mortgage pre-approval is often required at the time of signing. This is in order to show the builder that you’re financially qualified.

Rates and terms may change by final closing, so buyers should be prepared to re-qualify closer to occupancy. Click here to learn more about evaluating your financial situation and getting pre-approved for a mortgage.

Final Mortgage Approval at Closing

At final closing, you’ll need to secure a mortgage for the remaining balance of the purchase price (minus the deposit you’ve already paid).

Be prepared to:

- Re-qualify under current mortgage stress test rules.

- Provide updated income/employment information.

- Work with a mortgage broker or lender experienced in pre-construction.

Interim Occupancy vs. Final Closing

In condos, you may get interim occupancy before you officially own the unit. During this period, you pay occupancy fees, which are different than mortgage payments. You can’t mortgage the property until the date of your final closing.

Government Programs & Incentives

When financing your Toronto pre-construction condo, remember to take advantage of all available government programs and incentives. These may include:

- First-Time Home Buyers’ Tax Credit

- RRSP Home Buyers’ Plan

- GST/HST New Housing Rebate

- Land Transfer Tax Rebates

- And more! (Learn more here.)

Check out our blog post “Everything You Need to Know About Buying a Pre-Construction Condo in Toronto: FAQs” for more info.

Do you have questions about financing or buying a pre-construction condo in Toronto? Connect with BAZIS on Facebook, X, or Instagram – we’d love to hear from you!

What Are the Going Rental Rates Across Toronto in 2025?

Toronto is one of Canada’s most dynamic and desirable cities, and its rental market reflects that. Whether you’re moving into your first apartment, relocating to a new neighbourhood, or exploring investment opportunities, it’s helpful to understand what the going rental rates look like across different areas of the city.

In this guide, we break down average rental prices by neighbourhood, explore what influences these rates, and offer tips for finding the right fit for your lifestyle and budget.

Why Are Toronto Rental Prices So Varied?

While the average rent per Toronto is $2,036/month, the amount that renters end up actually paying depends mainly on which neighbourhood they choose.

Toronto is made up of dozens of distinct neighbourhoods, each with its own character, amenities, and housing options. Rental prices depend on several factors:

- Proximity to the downtown core

- Access to public transit

- Neighbourhood prestige and popularity

- Building type (condo, purpose-built rental, basement apartment, etc.)

- Size and layout of the unit

Average Rental Prices by Area

Here’s a snapshot of what you can expect to pay in 2025, based on recent market data:

Downtown Core (Entertainment District, Financial District, King West)

Living in the heart of the action comes at a premium.

- 1-bedroom condo: ~$2,450–$2,850/month

- 2-bedroom condo: ~$3,000–$3,750/month

These neighbourhoods offer unbeatable access to restaurants, nightlife, and jobs, making them popular with young professionals and urbanites.

Midtown (Yonge & Eglinton, Davisville Village)

Midtown strikes a balance between urban convenience and a more residential feel.

- 1-bedroom condo: ~$2,400–$3,800/month

- 2-bedroom condo: ~$4,200–$4,300/month

The area is well-served by transit, with great shopping and dining options.

East End (Leslieville, Beaches, Danforth)

The east end has grown in popularity for its laid-back vibe and sense of community.

- 1-bedroom condo/apartment: ~$1,850–$2,600/month

- 2-bedroom: ~$2,500–$3,000/month

You’ll find charming low-rises, boutique condos, and tree-lined streets here. The East End is typically a great fit for families and creative professionals.

West End (High Park, Roncesvalles, Junction)

Known for its parks and character, the west end is another attractive choice.

- 1-bedroom condo/apartment: ~$1,950–$2,950/month

- 2-bedroom: ~$2,650–$4,400/month

These areas are ideal if you prefer a quieter atmosphere while still being close to downtown.

North York (Sheppard, York Mills, Bayview)

Further north, you’ll find more spacious units at slightly lower prices, plus easy access to highways which is convenient for commuters.

- 1-bedroom condo: ~$2,000–$2,700/month

- 2-bedroom condo: ~$3,300–$3,600/month

North York offers a suburban feel with plenty of amenities.

Tips for Renters

- Set your budget realistically: Factor in not just rent, but utilities, insurance, and commuting costs.

- Be prepared: The rental market moves quickly, so have your documents ready.

- Consider lifestyle: Do you value walkability? Green spaces? Proximity to work?

- Explore different building types: New condos often cost more than older apartments, but may offer better amenities.

Looking Ahead

As Toronto continues to grow, rental rates may fluctuate, especially in up-and-coming neighbourhoods. Staying informed about the market can help you make the best choice for your needs.

At BAZIS, we understand the Toronto housing market deeply and are proud to create iconic communities that reflect the city’s vibrancy. Whether you’re renting or buying, Toronto has a neighbourhood that’s just right for you.

Questions? Comments? Connect with BAZIS on social media (Facebook, X, or Instagram) and let us know!

Summer 2025 Toronto Real Estate Market Outlook: Opportunity Awaits Buyers

As we head into the summer of 2025, Toronto’s real estate market is showing encouraging signs of stabilization. After months of uncertainty fuelled by shifting interest rates, global trade tensions, and economic unease, today’s market presents opportunities for buyers that haven’t been seen in years.

If you’ve been thinking about purchasing a condo in Toronto, this summer might be the perfect time to make your move. Here’s what you need to know.

More Choice for Condo Buyers

Condo shoppers are enjoying greater selection than ever. According to the Toronto Regional Real Estate Board (TRREB), the number of new condo listings in the GTA rose 25.2% in Q1 2025 compared to the same period last year. This surge in available inventory is giving buyers the upper hand with more options to choose from and the ability to negotiate pricing or incentives.

Prices Have Adjusted, Making Condos More Affordable

After years of rapid price growth, the market has cooled slightly, making condos more affordable. TRREB reports the average selling price of a GTA condo in Q1 2025 was $680,146, a 2.2% decrease compared to the previous year. In the City of Toronto specifically, the average price for condos dipped by 6.5% year-over-year to about $683,000 as of May 2025.

For buyers, this means greater affordability, not only in purchase price but also in borrowing costs. With the Bank of Canada cutting rates several times in recent months, mortgage rates for condo purchases have become more attractive. As of mid-June 2025, some lenders are offering three-year fixed rates as low as 3.89%, making it easier to save on financing.

As TRREB Chief Information Officer Jason Mercer noted, “Home ownership costs are more affordable this year compared to last. Average selling prices are lower, and so too are borrowing costs.” This combination of lower prices and better mortgage terms makes home ownership more attainable for a wider range of buyers, including first-time buyers and investors.

First-Time Buyers Have an Advantage

Market conditions are especially favourable for first-time buyers. The federal government has introduced measures to support new homeowners, including more flexible insured mortgage rules and longer amortization periods. These policies, combined with lower condo prices, are expected to bring more first-time buyers into the market this year.

TRREB CEO John DiMichele also emphasized that restoring affordability is now a national priority, with housing initiatives aimed at boosting supply and reducing taxes. As these efforts unfold, new construction could pick up in the coming years, but today’s buyers stand to benefit from the current buyer-friendly market conditions.

The Rental Market Is Easing

Over the past year, the GTA’s rental market has seen a surge in supply. This has provided renters with more negotiating power and stabilized rental rates after years of sharp increases. However, as borrowing costs decline and economic confidence improves, experts predict that some renters may transition into homeownership, especially if they see attractive deals in the condo market.

This shift could spark renewed demand for condo developments later in 2025 and into 2026. Buyers who purchase now may benefit not only from today’s lower prices but also from future market appreciation as demand returns.

Market Balance Expected to Improve

While the condo market remains in “buyer’s market” territory, recent trends suggest conditions are beginning to balance. Seasonally adjusted data shows that May home sales in the GTA were up for the second month in a row. At the same time, new listings, while elevated, are growing at a slower pace than sales, hinting at a gradual tightening of supply.

Analysts from RBC and CREA (Canadian Real Estate Association) have also noted early signs of recovery across Canadian housing markets as trade tensions ease and economic uncertainty declines. This positive momentum could lift buyer confidence as the summer progresses.

Bottom left image: TRREB

Why Summer 2025 Is a Great Time to Buy

For condo buyers, this summer offers a rare alignment of positive factors:

- Increased supply and choice mean more options and negotiating power.

- Lower average prices improve affordability.

- Reduced mortgage rates cut monthly costs.

- Government support for first-time buyers expands purchasing opportunities.

- Potential future price appreciation is in sight as market confidence rebuilds.

While some investors may still be cautious given past volatility, those ready to buy stand to benefit from a market that favours buyers in both pricing and selection.

Advice for Buyers in 2025

Toronto’s real estate market in summer 2025 is creating opportunities that buyers haven’t seen in years. With affordability improving, mortgage rates easing, and inventory levels high, today’s homebuyers can approach the market with confidence. Whether you’re looking for a home or an investment, this season may be the right time to make your move.

As always, working with knowledgeable real estate professionals and developers can help you make the most of today’s buyer-friendly conditions. Stay informed, stay confident, and you could find the perfect Toronto condo this summer.

What are your predictions for Toronto’s real estate market? Connect with BAZIS on social media (Facebook, X, or Instagram) and let us know!

Spotlight on Emerging Commercial Real Estate Trends in Toronto

Toronto, the bustling metropolis known for its vibrant culture, diverse population, and thriving economy, is also a hub of commercial real estate investment opportunities. As the city continues to develop and change over time, investors, developers, and industry professionals are paying close attention to the trends impacting Toronto’s commercial real estate scene.

At BAZIS, we’re known for designing iconic residential communities — but increasingly, our developments include thoughtfully integrated commercial components, such as ground-floor retail or co-working lounges. These mixed-use features enhance urban living while supporting long-term investment potential, making it important to stay on top of emerging trends in Toronto’s evolving commercial real estate landscape.

Here are some key trends currently influencing Toronto’s commercial real estate market:

Rise of Mixed-Use Developments

One of the prominent trends in Toronto’s commercial real estate sector is the rise of mixed-use developments. These projects combine residential, commercial, and retail spaces into one property to form vibrant communities that meet modern city dwellers’ needs while providing attractive investment opportunities for developers and investors. Mixed-use developments are quickly becoming popular for their convenient living situations while providing exciting investment prospects for developers and investors.

Focus on Sustainability and Green Building Practices

Over recent years, there has been an increased emphasis on sustainability and green building practices within Toronto’s commercial real estate industry. Developers and investors in Toronto are incorporating eco-friendly features and technologies into their properties, such as energy-efficient building designs, green roofs, and solar panels, in keeping with Toronto’s commitment to reduce carbon emissions while simultaneously increasing environmental sustainability. Sustainability has become a central aspect of commercial real estate projects in Toronto.

Adapting to Remote Work with Purpose-Built Amenities

The shift toward remote and hybrid work has transformed how people live — and what they expect from their homes. Today’s condo buyers are seeking spaces that support productivity and flexibility, such as co-working lounges, meeting pods, and high-speed internet connectivity. Developers in Toronto, including BAZIS, are integrating these features into residential communities to meet the evolving needs of remote workers and add long-term value for residents and investors.

Why Mixed-Use Condo Developments Appeal to Modern Investors

For investors looking to maximize value, mixed-use developments offer more than just a place to live — they offer lifestyle and income potential. Integrated retail or co-working amenities can increase foot traffic, convenience, and desirability, making units in these buildings more attractive to renters and end-users. As Toronto becomes more and more dense, properties that blend residential and commercial uses stand out for their long-term appreciation and resilience.

Toronto’s commercial real estate market is experiencing rapid change driven by trends such as mixed-use developments, sustainability initiatives, and remote work adaptations. As the city continues to evolve, it’s essential for industry professionals to stay updated on these developments and adapt their strategies accordingly to capitalize on any opportunities they present. By staying informed about the latest commercial real estate trends, investors and developers can better position themselves for success in this ever-evolving marketplace.

Interested in investing in a mixed-use condo development in Toronto? Explore BAZIS communities designed for modern urban living — and smart investing.

Questions? Comments? Connect with BAZIS on social media (Facebook, X, or Instagram) and let us know!

Why Bartley Towns Is One of the Best Places to Live Near the Eglinton LRT

Big changes are coming to Toronto’s east end – and they’re arriving right at Bartley Towns’ doorstep.

The Eglinton Crosstown LRT, one of the city’s largest transit infrastructure projects in decades, is nearing completion. With service planned to begin as early as September 2025, this 19-kilometre rapid transit line will stretch from Kennedy in the east to Mount Dennis in the west, offering 25 new stations and a faster, more reliable way to move across the city.

For future residents of Bartley Towns, this means exceptional access to the best of Toronto – without the traffic. Located just minutes from the Don Valley Parkway and a short 14-minute walk from the Sloane Station on the new LRT line, Bartley Towns offers a rare combination of urban convenience, smart design, and modern style in a family-friendly neighbourhood.

Faster Commutes, Greater Convenience

Whether you’re commuting downtown for work, heading to class, or meeting friends across the city, the LRT makes getting there quicker and easier. The Crosstown LRT will run in a dedicated lane separate from traffic, which means no more sitting in gridlock or waiting endlessly for a delayed bus. In fact, travel times are expected to improve by up to 60% compared to current bus service along Eglinton Avenue.

For Bartley Towns residents, the LRT will connect you directly to the TTC subway system and multiple GO lines. Whether you’re heading to the Financial District, the University of Toronto, or the city’s west end, seamless transit connections are right outside your door.

A More Connected Neighbourhood

The arrival of the LRT is also bringing new energy and growth to the surrounding area. Improved transit access often sparks neighbourhood growth, attracting new businesses, schools, and services that help to create a more walkable, vibrant community. From shopping and dining to parks and recreation, Bartley Townhome residents will find more and more of what they need close to home.

And thanks to the LRT’s efficient service, you’ll spend less time commuting and more time enjoying what matters – whether that’s dinner with the family, an after-school activity, or a weekend adventure.

Long-Term Value for Homeowners

It’s also good to remember that buying a home near reliable, high-frequency transit isn’t just a lifestyle upgrade – it’s a smart investment. Studies consistently show that properties near new transit lines tend to appreciate in value over time, as demand grows for homes in well-connected neighbourhoods.

At Bartley Towns, you’re not only getting a beautifully designed modern townhome, but also a location with built-in long-term value. With the DVP, Eglinton Crosstown LRT, and numerous amenities just minutes away, this is a place where families can put down roots and thrive for years to come.

Experience Life at Bartley Towns

Bartley Towns is where thoughtful design meets unbeatable convenience. Nestled in a quiet pocket just off Eglinton Avenue East, the community offers elegant, spacious townhomes that are perfect for growing families, professionals, and anyone looking to live close to it all – without the downtown price tag.

With the LRT set to open soon, there’s never been a better time to discover Bartley Towns. Learn more and explore available homes by visiting the Bartley Towns webpage.

Questions? Comments? Connect with BAZIS on social media (Facebook, X, or Instagram) and let us know!

BAZIS Brings Contemporary Condo Living to the Shops at Don Mills Neighbourhood

We’re excited to announce that BAZIS is set to transform the landscape of Toronto’s Shops at Don Mills neighbourhood with our ambitious new condominium project at 895 Lawrence Avenue East. The dynamic development will feature 1,150 suites across three buildings and will offer exceptional amenities, ground-floor retail, and restaurants, reflecting BAZIS’ commitment to urban intensification and modern living.

Read on to learn more about this upcoming condo community and its prime location.

Don Mills: A Visionary Neighbourhood

895 Lawrence Avenue East is located immediately west of the CF Shops at Don Mills shopping centre at Don Mills Rd. and Lawrence Ave. East, just west of the Don Valley Parkway (DVP) and east of Leslie St. The 2.14-acre site offers residents unparalleled access to a blend of retail, dining, and entertainment options, making it a prime spot for urban dwellers seeking convenience and lifestyle amenities.

As one of Toronto’s first master-planned communities, Don Mills was designed in the 1950s to blend residential living with green space, retail, and community amenities. Nestled in North York, it offers a unique mix of urban convenience and suburban charm, with winding streets, mid-century architecture, and access to scenic parks and trails. Culturally diverse and well-connected, the neighbourhood is home to schools, cultural centres, and major roadways like the DVP and Lawrence Avenue. Don Mills remains a vibrant and evolving community that’s ideal for those who value lifestyle, location, and thoughtful design.

Proximity to CF Shops at Don Mills

The CF Shops at Don Mills is Toronto’s premier open-air shopping destination, boasting over 70 retail stores and a total floor space of 511,824 square feet. Developed by Cadillac Fairview, this lifestyle centre features a mix of high-end retailers, gourmet restaurants, and entertainment venues, including a Cineplex VIP Cinemas and the recently opened Eataly, which occupies nearly 9,800 square feet. The centre’s design, characterized by storefronts facing a network of private internal streets and a central square with a clock tower, fosters a vibrant community atmosphere and offers plenty of modern conveniences and entertainment options close to home.

Enhanced Connectivity and Amenities

Residents of 895 Lawrence Avenue East will benefit from excellent connectivity, with major roadways like Don Mills Road and Lawrence Avenue East providing easy access to the rest of Toronto. Public transportation is readily available, and the upcoming Eglinton Crosstown LRT is expected to enhance east-west connectivity, further improving accessibility. Additionally, the neighbourhood is home to several municipal parks, including Bond Park and Moccasin Trail Park, offering ample recreational opportunities.

BAZIS’ redevelopment of 895 Lawrence Avenue East signifies a bold step in urban residential planning, seamlessly integrating modern living spaces with the rich tapestry of amenities offered by the Shops at Don Mills neighbourhood. With its strategic location adjacent to the CF Shops at Don Mills, enhanced connectivity, and thoughtful design, this project is poised to become a landmark development, catering to the evolving needs of Toronto’s urban population.

895 Lawrence Avenue East is coming soon. Register now to receive priority community updates as soon as they’ve available.

Questions? Comments? Connect with BAZIS on social media (Facebook, X, or Instagram) and let us know!

Top Reasons to Invest in Toronto: A Guide for Real Estate Investors

Toronto is one of Canada’s most dynamic, diverse, and desirable cities. It’s also a top destination for real estate investors. With a thriving economy, strong population growth, and a resilient housing market, Toronto provides exciting long-term opportunities for both seasoned and first-time investors. Whether you’re looking for capital appreciation, reliable rental income, or a foothold in one of North America’s most competitive urban markets, Toronto is the place to be – and to buy.

Here’s a look at some of the top reasons why investing in Toronto real estate is a smart move.

- A Thriving Economy and Job Market

Toronto is Canada’s economic powerhouse. As the country’s financial centre and one of North America’s fastest-growing tech hubs, Toronto attracts professionals, entrepreneurs, and international talent at an extraordinary rate. Major employers span banking, healthcare, education, technology, and media – all industries that continue to grow and support a vibrant urban population.

With ongoing economic strength comes sustained housing demand, making Toronto a solid foundation for real estate investment.

- Strong Population Growth and Immigration

Toronto is the fastest-growing city in all of North America, thanks in large part to immigration. Even as Canada adjusts its immigration levels to alleviate pressures on housing, infrastructure, and social services, the GTA continues to attract new residents – including professionals, families, and international students. Many newcomers settle in Toronto long-term, creating an ever-expanding demand for quality housing.

This population growth is one of the key factors behind the city’s long-term real estate value.

- Limited Land Supply and High Demand

Did you know that geography plays a major role in Toronto’s real estate dynamics? With Lake Ontario to the south and Ontario’s Greenbelt protecting land to the north, there’s limited room for outward expansion. As demand for housing continues to rise in the Greater Toronto Area, supply remains constrained. This drives appreciation and makes urban condo developments especially attractive for investors seeking long-term growth.

- Expanding Transit and Infrastructure

Toronto is in the midst of a major infrastructure transformation. From the Ontario Line (a new 15.6-kilometre subway line that’ll run from Exhibition Place, through downtown, all the way to the Eglinton Crosstown LRT at Don Mills Road) and the Eglinton Crosstown LRT (a midtown connection between east and west Toronto with 25 stations along a dedicated route, including one just minutes away from BAZIS’s Bartley Towns community) to GO Train Expansion projects and the SmartTrack Stations Program, the city’s transit network is becoming more connected than ever.

New homes and condos that are located near new or existing transit lines often see stronger appreciation, making transit-oriented developments a strategic investment choice. As Toronto continues to evolve, accessibility is sure to stay a top priority for both buyers and renters.

- Stability and Resilience

In a global context, Toronto offers the level of political and economic stability that many investors are looking for. Canada’s strong legal system, banking regulations, and transparent processes make real estate transactions more secure – especially for international buyers.

Even during global economic downturns, Toronto’s housing market has proven resilient, bouncing back faster than many other urban centres around the world.

- A World-Class City

Beyond economics, Toronto offers exceptional lifestyle value. The city is home to top-ranked universities, cutting-edge health care, a thriving arts scene, and unparalleled cultural diversity. Its neighbourhoods are vibrant and walkable, with something to offer everyone – from young professionals to growing families to retirees.

Toronto isn’t just a place people need to live – it’s a city they want to live in. That sense of desirability continues to drive demand across the housing market.

Toronto is a thriving, in-demand city – and for real estate investors, the time to act is now. Whether you’re looking to invest in a new build or expand your portfolio, Toronto offers opportunity, growth, and security.

At BAZIS, we’re proud to shape the city’s skyline with iconic, thoughtfully designed projects in Toronto’s most sought-after locations. If you’re considering an investment in Toronto real estate, explore our current and upcoming projects – and discover why a BAZIS home is right for you.

Questions? Comments? Connect with BAZIS on social media (Facebook, X, or Instagram) and let us know!

Toronto’s 2025 Winter Real Estate Market Outlook: Trends, Predictions, and Opportunities

As we step into 2025, the Toronto housing market is set to gradually recover after a challenging 2024. High interest rates shaped last year, but recent rate cuts and growing economic optimism are paving the way for a steadier, more active market. This quarterly update focuses on current market conditions, with a spotlight on the condo market – a key choice for first-time buyers and investors alike.

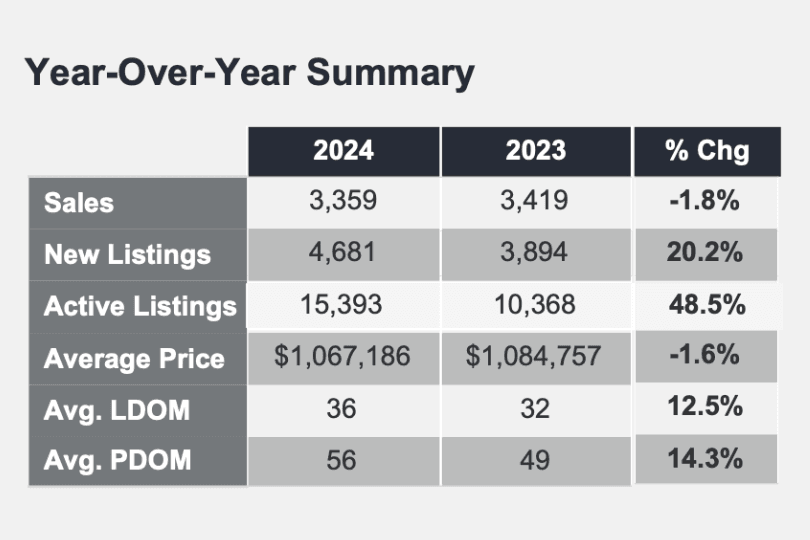

2024 in Review

The Toronto Regional Real Estate Board (TRREB) reported that 2024 ended with a 2.6% increase in sales compared to 2023, totaling 67,610 transactions. The standout trend, however, was a 16.4% surge in new listings, giving buyers more options and bargaining power. This shift in supply and demand kept prices steady, with the average selling price edging down by just 0.8% to $1,117,600.

Condos saw the biggest price drops among housing types, largely due to affordability challenges and fewer first-time buyers entering the market. TRREB highlighted that many potential buyers held off, waiting for further interest rate cuts, which hit the lower-priced condo segment the hardest.

Image: TRREB

Interest Rates: A Game-Changer

Borrowing costs were a major factor in the 2024 housing market. High interest rates for most of the year made affordability a challenge. However, the Bank of Canada introduced significant rate cuts in the second half of 2024, helping improve market conditions. More rate cuts are expected in 2025, which could boost buyer confidence and activity. TRREB President Elechia Barry-Sproule said: “Further rate cuts in 2025 and home prices remaining below their historic peaks should result in improved market conditions over the next 12 months.”

Condo Market Outlook: Why 2025 Is the Year to Act

The Toronto condo market remains an affordable and accessible option for homebuyers, especially first-time buyers. RE/MAX notes that condos priced between $450,000 and $750,000 are a popular choice for those entering the market.

While condo prices dipped in 2024, this creates a great opportunity for buyers in 2025. With borrowing costs coming down and prices still below their peak, condos offer strong value for those looking to invest in Toronto real estate. Plus, the higher inventory from 2024 gives buyers plenty of options to find a home that fits their needs and budget.

What’s Driving the Market in 2025?

Several key factors are driving optimism in Toronto’s housing market this year:

Lower Borrowing Costs: Continued interest rate cuts are reducing mortgage payments, encouraging more buyers and sellers to return to the market.

Steady Price Growth: RE/MAX forecasts a balanced market with a slight 0.1% increase in average home prices and a 12.5% rise in sales.

First-Time Buyers: Increased confidence among first-time buyers, noted by RE/MAX and the Canadian Real Estate Association (CREA), is expected to energize the condo market.

Improved Accessibility: Policies like longer mortgage amortizations and relaxed lending rules are making it easier for more people to achieve homeownership.

Challenges to Watch

Despite a positive outlook, affordability remains a challenge, especially in Toronto’s competitive market. RBC points out that high property values continue to stretch buyers’ budgets, slowing recovery in the condo market. Affordability strains “set an impossibly high bar to clear for many first-time homebuyers. We expect those strains will keep sales recovery gradual and price increases minimal in the year ahead. Toronto and Vancouver – Canada’s most expensive markets – could even see further erosion of condo prices amid rising inventories.” However, these challenges are eased by the availability of more affordable units and improving financial conditions.

Advice for Buyers in 2025

For those considering purchasing a condo in Toronto, now is a great time to start exploring your options. With prices remaining stable and borrowing costs on the decline, buyers have a window of opportunity to secure a property before the market heats up again.

At BAZIS, we specialize in creating thoughtfully designed condominium residences that cater to modern lifestyles in Toronto. Our projects are built with quality, style, and convenience in mind, offering the perfect investment for homebuyers and investors alike.

What are your predictions for Toronto’s real estate market? Connect with BAZIS on social media (Facebook, X, or Instagram) and let us know!

Real Estate Investment Strategies for Millennials in Toronto

Did you know that Toronto has one of the fastest-growing real estate markets in North America? For millennials, rising property prices can make homeownership challenging, but they also present unique opportunities for building wealth through real estate investment.

In Toronto’s competitive market, understanding effective strategies can set young investors up for success. Here are some tailored real estate investment approaches for millennials looking to make their mark.

Understanding the Toronto Real Estate Market

Before diving into any investment, it’s crucial to familiarize yourself with the nuances of Toronto’s real estate market. Known for its vibrant neighbourhoods and ever-evolving nature, Toronto’s housing market varies widely depending on location, development projects, and broader economic factors.

Keep an eye on areas like Thorncliffe Park, Flemingdon Park, and East Harbour, where new transit projects like the Ontario Line are set to enhance connectivity and potentially boost property values. Staying informed about pricing trends, vacancy rates, and emerging neighbourhoods can help you make confident, data-driven investment decisions.

Strategy 1: House Hacking

House hacking is an innovative way for millennials to break into the Toronto market while generating rental income. This strategy often involves buying a duplex or triplex, living in one unit, and renting out the others to help cover mortgage costs. It’s a great way to build equity and generate passive income while lowering housing costs.

In Toronto, these types of properties are often pricey and in high demand, making this option out of reach for many. However, for those who can afford the significant upfront investment of a multi-unit property in Toronto, the long-term benefits can be substantial. House hacking in Toronto also requires extensive research to identify opportunities in areas where rental demand is strong (such as along the subway lines or near university campuses), evaluation of property management options, and calculation of potential rental income. Additionally, it’s important to understand landlord-tenant laws in Ontario, as they can significantly impact your ability to manage rental properties.

Strategy 2: Condo Investing

Condos have become a go-to option for millennials in Toronto, thanks to their relative affordability compared to detached homes and their appeal to renters seeking urban living. With dynamic neighbourhoods like King West and Liberty Village offering excellent amenities, condos are a practical choice for young investors.

Thinking about investing in a condo? Consider factors like location, building reputation, and potential rental income to make an informed decision. Research trends such as vacancy rates, condo fees, and future developments in the area. Working with a realtor specializing in Toronto’s condo market can provide valuable insights and help you make informed decisions.

Strategy 3: Rent-to-Own Programs

Rent-to-own programs can offer a creative solution for millennials who struggle to save for a large down payment. These programs allow you to lease a property with the option to purchase it later at a predetermined price, giving you time to build your financial stability and equity while living in your future home – perfect if saving for a down payment feels out of reach.

While rent-to-own programs aren’t as common in Toronto as in other markets, they can still be a viable option. It’s important to thoroughly understand the terms of the agreement, including the lease duration and how rent credits apply to the final purchase. Consulting with a real estate professional can help you navigate these contracts and determine if this strategy fits your needs.

Maximizing Your Investment Potential

Toronto’s real estate market offers a wealth of opportunities for millennials ready to take the plunge. Investing in real estate presents Toronto millennials with an excellent way to build wealth and achieve long-term prosperity. Whether you choose house hacking, condo investing, or exploring a rent-to-own option, these strategies allow you to leverage Toronto’s vibrant real estate market for long-term wealth creation. For all of these strategies, success lies in thorough research, careful planning, and seeking professional guidance in order to make informed investment decisions.

Real estate isn’t just about property ownership – it’s about crafting a financial strategy that works for you. By staying informed, thinking creatively, and approaching the market with confidence, you can navigate Toronto’s dynamic market and set yourself up for long-term success. At BAZIS, we’ve worked with countless investors and first-time buyers to help them realize their real estate goals.

Which of these real estate investment strategies resonates with you? Connect with BAZIS on social media (Facebook, X, or Instagram) to share your thoughts or ask questions. We’d love to hear from you!