Considering Using a Property Management Company? Here’s What You Need to Know

Investing in real estate can be a lucrative way to build wealth, but managing properties requires time, expertise, and effort. Property management companies can help investors maximize their returns and minimize the headaches associated with being a landlord. Are you a Toronto real estate investor considering hiring a property management company? Here’s what you need to know:

The Benefits of Hiring a Property Management Company

- Efficient Rent Collection: Property managers streamline rent collection with regular office hours and online payment options, ensuring consistent cash flow.

- Reduced Vacancies: Experienced managers reduce vacancy periods by finding and retaining high-quality tenants through effective marketing and tenant screening.

- Appropriate Rent Pricing: Property management companies use market data to set competitive rent prices, balancing maximum revenue with tenant affordability.

- Property Maintenance: Regular maintenance and prompt repairs by property managers help maintain and increase property value, preventing small issues from becoming costly problems.

- Legal Compliance: Property management companies ensure all lease agreements comply with local regulations, reducing legal risks.

- 24/7 Support: With round-the-clock emergency services, property managers handle urgent issues, freeing landlords from late-night calls.

- Accounting and Tax Assistance: Property management companies provide year-end financial summaries, making tax preparation easier and more accurate.

- Cost Savings: Property managers often get discounted rates from contractors due to their volume of work, passing savings onto property owners.

Considerations for Investors

While property management companies offer numerous benefits, there are considerations you’ll want to keep in mind as a smart investor. These include:

- Cost: Management fees can range from 5% to 10% of rental income. However, the efficiency and expertise they provide often result in higher overall profitability.

- Transparency: It’s crucial to choose a reputable company that is transparent about their fees and services. Review contracts carefully to avoid hidden charges.

- Relationship Management: A good relationship with your property manager is vital. Clear communication and regular updates help ensure your investment goals are met.

Key Takeaways

Hiring a property management company can significantly enhance the profitability and sustainability of real estate investments. They handle the day-to-day operations, allowing investors to focus on growth and acquisition. However, it’s important to select a reliable and reputable firm to ensure you receive the full benefits.

For those considering whether to hire a property manager, weighing the pros and cons and understanding the financial implications is essential. Ultimately, a well-chosen property management company can be a valuable partner in your real estate investment journey.

In Conclusion

Property management companies offer a host of advantages that can make real estate investing more manageable and profitable. From efficient rent collection and reduced vacancies to legal compliance and cost savings, their services can transform the way you manage your investments. By carefully selecting a reputable firm, investors can enjoy the peace of mind and financial benefits that come with professional property management.

If you’re considering investing in Toronto real estate, we have plenty of tips for investors of all types. Learn why it’s the perfect time to invest in Toronto’s pre-construction market, the importance of location when buying pre-construction condos in Toronto, how to make your Toronto condo more renter-friendly, and plenty more on our blog (check out the handy Investors section).

Questions? Comments? Connect with BAZIS on social media (Facebook, X, or Instagram) and let us know!

Embracing Opportunity: Why Now Is the Perfect Time to Invest in Toronto’s Pre-Construction Condo Market

Toronto’s real estate market is buzzing with excitement, and it’s a great time for those looking to buy pre-construction condos. Despite some recent challenges, things are looking up, offering investors new opportunities for growth and success.

Let’s take a closer look at the future of the pre-construction condo market in Toronto, where positive momentum is building. A combination of factors is coming together to enhance the buyer experience, making it an exciting time to get into the pre-construction condo market. Check out our guide to buying pre-construction condos in Toronto before you dive into the condo market.

A Positive Outlook

Despite the ups and downs of the condo market, there’s a glimmer of hope on the horizon. Condo sales saw a brief dip last year, but 2024 and especially this springtime has brought an increase in new listings, revitalizing the market. This increase not only balanced supply and demand but also led to lower prices, creating a favourable environment for homebuyers.

Looking ahead, there’s a lot of anticipation about what the Bank of Canada might do next. Interest rates are predicted to be cut in June, which could really shake up the housing market. Lower interest rates mean more affordable mortgages, which could increase demand in pre-construction condos and create new opportunities for investors. Lower interest rates can also mean that home prices increase, however – so it’s not necessarily a good choice to wait until interest rates drop to much lower rates.

Why Invest Now?

With the market constantly changing, now is an excellent time to invest in Toronto’s pre-construction condo market. With reduced competition and steady inventory, buyers share a unique opportunity to secure a great deal in the Toronto real estate market. Unlike previous years where the typical year-over-year price of pre-construction condos increased, prices have remained stable, and developers are sweetening the pot with incentives like extended deposit structures and state-of-the-art amenities.

If you’re looking to take advantage of the current market conditions, you’ll want to do so quickly. With interest rate changes on the horizon, there is uncertainty regarding how it’ll affect the market, so it’s a great time to lock in a good price on a new pre-construction condo. If interest rates are cut and make things more affordable, demand is expected to increase, and eventually, prices too. By waiting for construction to finish, you can skip the resale market and set yourself up for long-term value.

More Incentives for Buyers

To make things even more appealing for buyers, Toronto developers are offering some amazing incentives. Extended deposit structures mean you can get into a pre-construction condo with less money upfront, making it easier to enter the market. Additionally, incentives like free or discounted parking, the right to lease during the occupancy phase, and credits to cover closing costs add even more value.

Trends in Condo Design

Beyond market dynamics, a wave of innovation is sweeping through condo design, shaping the future of urban living. Sustainability is now a key focus, with developers incorporating eco-friendly practices and amenities like green roofs and energy-efficient appliances.

Smaller units are on the rise, reflecting a fast-growing city and a shift toward more efficient and sustainable living. These compact but thoughtfully-designed spaces maximize functionality without compromising comfort.

Additionally, amenities are redefining the condo living experience, with state-of-the-art facilities creating a sense of community and luxury, right at home. From fitness centres to rooftop terraces and co-working spaces, these amenities elevate the quality of life for residents.

Smart technology is transforming condo living, making it more convenient, comfortable, and connected. Features like smart locks and thermostats, app-controlled entry systems, and parcel lockers are now common in new pre-construction condos.

Embrace Opportunity

It’s a great time for investors to take advantage of Toronto’s pre-construction condo market. With a positive market outlook, strategic timing, incredible incentives, and innovative design features, buyers can feel confident buying a pre-construction condo in Toronto.

Do you have any questions about the future of the pre-construction condo market in Toronto? Connect with BAZIS on social media (Facebook, X, or Instagram) and let us know!

Everything You Need to Know About Toronto’s 2024 Real Estate Market Forecast

As we head into 2024, things are looking bright for potential new home and condo purchasers in Toronto. While the Toronto real estate market has been facing some challenges, there is hope for a rebound in 2024.

According to reports from RE/MAX, there was a decrease in average sale prices and the number of sales in the Greater Toronto Area (GTA) between 2022 and 2023. The average sale price decreased by 5.9%, from $1,203,916 in 2022 to $1,132,681 in 2023, and the number of sales decreased by 13.5%, from 67,452 in 2022 to 58,367 in 2023.

In the GTA in 2023, the market was considered a seller’s market. However, there could be a shift toward a balanced or buyer’s market by the end 2024, depending on the neighbourhood in question. Average residential sale prices are predicted to drop by 3%, whereas the number of sales is expected to grow by 10.4%.

The top three areas to keep an eye on in the GTA are the Durham Region, Markham/Richmond Hill, and downtown Toronto. Durham Region is particularly attractive due to its affordability and value. Markham/Richmond Hill is gaining popularity due to improved affordability, and downtown Toronto remains desirable for its access to public transit and walkability, as well as its proximity to endless amenities and cultural attractions.

In terms of new construction trends, there is a focus on smaller condo units that offer desirable amenities like terraces, swimming pools, and fitness facilities.

According to the Toronto Regional Real Estate Board (TRREB), the condo market has become more balanced, with sales increasing but listings growing at a faster rate. This has led to a slight decrease in the average price, providing some relief amidst higher borrowing costs. The market conditions have provided more choice and negotiation power for first-time buyers, resulting in lower selling prices on average. While the market is expected to tighten in the second half of 2024, relief in borrowing costs (including interest rates) is anticipated in 2024 and 2025 due to population growth and market trends. This, coupled with a relatively resilient economy, should make home ownership affordable for more households this year and moving forward.

According to the Royal LePage Market Survey Forecast, the aggregate price of a home in Canada is projected to reach $843,684 in Q4 2024, with a 5.5% annual increase, while the median price of a condo will jump 5% to $616,140. The majority of price appreciation is expected in the second half of 2024, with modest quarterly increases in Q3 and Q4. The prediction is based on the assumption that the Bank of Canada has finished raising interest rates and will hold the key lending rate at its current 5% through the first half of the year. Modest interest rate cuts are expected to begin in the late summer or fall, potentially pushing home prices up.

Overall, this is good news for the Toronto real estate market. A rebound in home sales is anticipated, driven by lower borrowing costs and increased affordability. According to Phil Soper, the President and CEO of Royal LePage, with the right conditions, the market could return to mid-single-digit home price appreciation, which is a healthy long-term affordability level.

Despite the challenges posed by the current market conditions, according to a Leger survey commissioned by Re/Max, 73% of Canadians consider real estate a sound long-term investment. What do you think? Learn more about new condos and townhomes for sale in downtown Toronto by checking out BAZIS’ new communities.

Do you have questions about the Toronto real estate market? Connect with BAZIS on social media (Facebook, Twitter or Instagram) and let us know!

Taking a Look at Toronto’s Fall 2021 Real Estate Market Positive Outlook

The pandemic has been a turbulent time for real estate in the Greater Toronto Area (GTA) and Canada at large. Whether you’re contemplating purchasing your first new home or condo, moving to a larger home, downsizing, or investing in real estate, you’re likely interested in the market and in being kept apprised of the latest trends and developments.

According to the Toronto Regional Real Estate Board (TREB), total residential real estate transactions were down 18% last month compared to the year before (9,046 transactions in September of 2021, compared to 11,033 transactions in September of 2020), and total new listings were down 34% compared to last year (just 13,483 listings in September of 2021, compared to 20,441 listings in September of 2020). The sharp decline in listings and smaller decline in transactions shows that there is a lack of supply in the GTA real estate market, so it’s not surprising to see that the average selling price increased 18.3% year over year (for an average of $1,136,280 in September of 2021, compared to $960,613 in September of 2020). Listing days on the market have also decreased (14 days in September of 2021, compared to 16 days in September of 2020).

With new home and condominium prices on a steady upward swing – with no sign of stopping – the best time to buy real estate in the GTA is, as always, as soon as possible.

RBC’s latest Housing Trends and Affordability Report, which measures affordability based on ownership costs as a percentage of household income, rose to a 30-year high in the second quarter of 2021. In Toronto, the report shows that the share of income a household would need to cover ownership costs is, on average, 59.1%.

The share of income necessary to cover the costs of owning a single-family detached home in the GTA is rising rapidly, making this dream more and more difficult for families to achieve. Soaring demand for detached homes during the pandemic made these homes’ prices increase even more. Fortunately, owning a condo apartment continues to be a more affordable option for many families, young professionals, and empty nesters and downsizers. Semi-detached homes and townhomes are also great options that offer much more value than fully-detached single family homes.

The strong real estate market can make getting into the market a challenge, but is good news for home owners and investors. For those considering purchasing a home or condo, the time is now. Toronto’s real estate market is strong and will have many opportunities for sellers, buyers, and investors alike.

Do you have questions about the Toronto real estate market? Connect with BAZIS on social media (Facebook, Twitter or Instagram) and let us know!

Everything You Need to Know About Investing in the Toronto Real Estate Market

Real estate is an extremely lucrative market. Investing and getting involved in the market seems simple in theory, but the reality is that there’s more to it than meets the eye. Having a clear goal in mind and knowing what methods you’ll use to approach this can make or break your success.

If you’re ready to take a leap of faith and tackle real estate investing in Toronto, read on for the top three tips that we recommend you keep in mind.

Outline and Understand Your Goals

As straightforward as this seems, many investors forget how important this step is and don’t stop to consider what goals they may have in mind. Investing in the real estate market can be broken down into two strategies based on your end goal. Are you looking to build equity or perhaps to develop another form of cash flow coming into your pocket each month?

Either one of these is a great starting point for anyone, and both these strategies can be used in tandem with one another.

Building Equity

It’s a common understanding that properties appreciate. In short, that’s what an equity gain is. You profit on the appreciation of the property when you decide to sell it or, in real estate terms, “flip it.” Without getting into the nitty gritty on tax implications, it’s recommended that you play the long-term game for an equity gain.

Approaching your real estate investment with an equity play is a great way to make a good chunk of change in Toronto. Year over year we’ve been seeing a steady increase in the Toronto condo market. As with anything, proper research on the market in Toronto will help set you up for success and some serious cash in the long run.

Developing a Form of Cash Flow

You now have a condo in your hands. It’s building equity, but what do you do now? You don’t want to pay out of pocket to keep the place running, or, worse, put yourself in a hole. The best method is to generate cash flow by renting it out.

A great place to start here is to do some research on what the average rental price is for some of the condos in your building.

Remember, you’re also building equity as the property is being rented out. So, why not take advantage and put both these strategies in play?

Higher Premiums

Let’s say you’ve decided on renting out the condo to get some money coming in monthly. How do you maximize it? There are a few ways you can get creative to help reduce your mortgage amount, allowing you to charge a premium.

Larger Down Payment

Making a larger down payment on a condo will help reduce the monthly mortgage you’ll need to pay. In most cases, if you make more than a 20% down payment, you can qualify for a 30-year amortization period. This allows for a cheaper mortgage amount, but the cool thing is that you’ll pocket more money every month.

Numbers, Not Emotions

We understand that your new property is a rental property and you want it to look good. But realistically, you must approach it with the mindset that it’s a business and your sole goal for this is to collect a cash flow or collect equity. So debating if the upgraded hardwood floor is better than what you currently have isn’t worth it.

Rental Properties Are on the Rise

Renting a property in Toronto has been on the rise for years. As condo prices increase, it has been difficult for new families to get into the market and to own a property right away. One of the quickest ways for someone to acquire a place is just by renting.

As more high-profile companies set up shop in Toronto, many people choose to rent their condos in the city to save on costs. Leverage the growing market to establish a portfolio for yourself in the long run.

We know making the first investment is hard, but did you know that real estate is becoming a bit more affordable? Learn about How New Townhomes & Condos Increase Affordable Housing in Toronto

Investing in Toronto condos is a great way to make some money, whether that be long-term investment or cash flow coming in monthly. Regardless, before you jump in the deep end, we recommend getting advice from a realtor – that way, you know you’re playing by the rules. Are you interested in investing in the Toronto real estate market? Join us on our social media pages (Facebook, Twitter and Instagram) and let us know!

10 Things to Consider Before Buying a New Townhome in North York

Buying a new home, townhome, or condo is a big investment and a decision that will impact your and your family’s lifestyle for years to come. If you’ve settled on the idea of buying a townhouse in North York, this blog post is for you.

Townhomes are a great option for families who are looking for their own home – with the spaciousness and privacy of a detached home – but with all the convenience and ease of condo living. As we outlined in a previous blog post about the benefits of townhome living, townhomes typically include multiple floors, designated parking spaces, and a shared wall with another home or homes. Townhome communities usually include shared communal spaces and are generally regulated by a homeowners’ association, which ensures that community maintenance and upkeep are taken care of and that everyone in the community abides by certain rules or guidelines. The benefits of buying a townhome include cost savings and affordability, amazing locations, single family living without the maintenance, a community vibe, and stunning shared spaces.

Not sure what the differences are between a townhome and a condo when it comes to home ownership, legal statutes, and privacy? Check out our blog post “Townhomes vs. Condos: Do You Know the Differences?”

If you’re going to buy a townhome specifically, there are unique considerations that you should take into account before making your decision. Here are 10 things to consider before you buy a new townhome in North York:

#1: Your Budget

First things first: before shopping for a townhome, get a mortgage pre-approval and know the budget that you’re working with. This will help you to shop smart, to not fall in love with properties that are out of your means, and to be able to act quickly once you’ve found “the one” (you’ll know it when you find it!).

Townhomes often offer good affordability because they’re less expensive to build compared to single detached homes, due to the high land costs in the Greater Toronto Area.

Using a mortgage affordability calculator is a good place to start if you’re not sure of what your budget is.

#2: Where You Want to Live

Location, location, location – it matters! Before buying a new townhome in Toronto, consider its location and if it’s in an area that you would truly like to live in. Things to consider about a neighbourhood include:

- Its proximity to major highways and transit options such as buses, subway or light rail transit (LRT) – both existing and upcoming/under construction are important to consider

- The schools in the area (their quality and whether there are options for French Immersion or Montessori, if you’re looking for those)

- The proximity of other community and family-friendly amenities such as daycares, libraries, community centres, restaurants, shops, grocery stores, salons, movie theatres, museums, attractions, and so on

- Its walk score and how many places you would be able to walk to on a daily basis (as well as whether or not the neighbourhood is pedestrian-friendly)

- Its bike score and how many nearby parks/green spaces there are to explore

- How close or far it is from your work, your family or friends’ homes, etc.

#3: Your Desired Lifestyle

How do you want to live? Do you enjoy walking to nearby shops and restaurants, or biking along natural trails? How do you get to work – walk, take transit, or drive? Do you have a family? How many kids? How about a dog? How much free time do you have on a typical weekday? How do you like to spend your weekends? All of these questions will have an effect on the type of lifestyle that you like to live.

Low-maintenance living can be yours with a townhome purchase, although townhome owners do have more maintenance to take care of than condominium or apartment owners. Because they’re smaller lots, townhomes are usually quite easy to maintain – and you won’t have to worry about exterior maintenance such as clearing snow or driveway repairs.

Many busy families today love the idea of maintenance-free living. A townhome lifestyle can give you more time to focus on what matters most: spending time with your family.

You’ll also want to find a townhome community that has a vibe that matches the lifestyle you’re looking for. Are the homeowners social and neighbourly, or do they stick more to themselves? Are there community events? Take these factors into consideration before buying a townhome.

#4: Homeowner Fees

Townhomes that have communal areas and shared common elements typically have a homeowners’ association, which is responsible for managing the neighbourhood’s common areas such as roadways and parks. If there’s a homeowners’ association, there will be fees associated with the management of these shared elements.

Before choosing a townhome to purchase, you’ll want to know whether it has a homeowners’ association and what the monthly fee costs, as well as what it covers or doesn’t cover. Make sure to factor this cost into your financial calculations and monthly budget.

For example, at our Bartley Towns community, the townhomes share a common element – the roadway – and so there is a monthly maintenance fee, although it’s quite low at just $113.95 per month.

#5: Mortgage Rates

Make sure you’re up to date on all the latest mortgage rules and regulations and take your time shopping around for the best rate. It’s always a good idea to compare mortgage rates from at least three different lenders.

#6: Community

When you buy a townhome, you don’t exist on an island – you become part of a community. This goes beyond the location or neighbourhood. A community consists of the people who live in the neighbourhood and the unique fabric that they weave together. Is the community diverse, friendly, and accessible? Do neighbours say hello to each other and maintain relationships? Do you get a good feeling when you walk through the community and when you visit the local shops? Find a community that feels a bit like home already, and before you know it you’ll be an integral part of it.

#7: Privacy and Personalization

Townhome communities have various degrees of privacy, based on the townhomes’ construction (how thick the walls are and how well they are sound-proofed) as well as the layout of the townhome designs (whether they’re stacked or not, for example). Make sure to talk to the builder (for a new townhome build) or neighbours (for an older build) to get an idea of what you can expect and to see if it suits your lifestyle.

You’ll also want to know what the rules are in terms of personalization, both to your new townhome’s interior and the exterior. Many townhomes have rules about what changes you’re allowed to do to the home’s exterior, for example.

#8: Style and Design

Just as you’d explore the features and finishes of a condominium or detached home before buying, you’ll also want to see if a townhome’s design suits your style before making the plunge. Details like flooring and kitchen countertops can be costly to replace, so you’ll save money and time if you purchase a home that you love right off the bat.

You’ll also want to consider the home’s layout and make sure that the floor plan works for you and your family.

#9: Amenities

Many townhome communities come with shared amenities or communal spaces such as driveways, roadways, parks, and sometimes even pools, gyms, or saunas. Determine which amenities are important to you and worth the extra cost, and then check out which amenities the townhome you’re looking at has.

#10: Builder

Lastly, know your builder. Buying a townhome from a reputable builder with a history of building and developing exceptional communities will secure your investment and put your mind at ease.

BAZIS has a long reputation of designing luxurious living spaces with the utmost attention to detail. Being able to successfully combine visionary architecture and design with marketing and construction has turned BAZIS into a reckoning force in pronouncing the city’s landscape.

The company is known for the unique architecture and high standards of luxurious finishes of its various residences. Knowing that each of BAZIS’ developments is crafted with exquisite design, superior location and elaborate amenities will give you peace of mind.

Make sure to follow BAZIS on social media (Facebook, Twitter and Instagram) for more tips, info, and industry updates.

Bartley Towns: Why It’s a Great Investment and Everything You Need to Know About the Grand Opening

This weekend, the Grand Opening of Bartley Towns, BAZIS’ newest Toronto townhome community, is officially here. Bartley Towns is ideally situated at Eglinton and Victoria Park within an established residential neighbourhood and near an area that’s in the midst of a commercial and residential revitalization. It’s a great community and neighbourhood to invest in, and it’s now open for sale.

Everyone knows the number one rule and mantra of buying real estate: location, location, location. BAZIS prides itself on building in prime neighbourhoods throughout the City of Toronto, and Bartley Towns is no exception. This community of just 84 townhouses is located in close proximity to the DVP north and south highway and minutes away from the new Eglinton LRT, perfectly situating the community for ease of commuting and getting around Toronto.

Read on to learn why buying a Bartley Towns townhome is a great investment and all the details you need to know about the Grand Opening this weekend.

Making a Good Real Estate Investment in Toronto

When it comes to making a solid real estate purchase and investment in the City of Toronto, there are a few key factors that come into play:

- Location

- Quality

- Potential

Bartley Towns is a sure winner in the location department. The townhome community is located on Victoria Park just a bit south of Eglinton and just east of the DVP, 600 metres to the Sloane LRT stop and about a 10-minute walk to Eglinton Square. Eglinton Square is going through a major redevelopment, which adds to the “potential” quality. And BAZIS is a renowned, reputable builder known for building high-quality, luxurious living spaces with the utmost attention to detail. Location, quality and potential: check, check and check.

Let’s explore each category closer.

Location

Bartley Towns’ neighbourhood is also known as Victoria Village or Victoria Park Village. This multicultural, diverse area features winding streets that are charming and pedestrian-friendly, and feels like a cozy enclave in the middle of the bustling City of Toronto.

The area’s quiet streets, well-maintained homes and large lawns make it welcoming and picturesque, and the neighbourhood is highly appealing to young and growing families. The community boasts numerous public and private schools (Bartley Towns has 17 schools within a 20-kilometre radius), libraries, community centres and parks with ample green space and walking trails as well as movie theatres, museums, grocery stores, and several public transit options, all of which add to the appeal for families. The neighbourhood also has an impressive 55 restaurants, bars and coffee shops, which makes it a great place to explore and to enjoy an evening out. Read our blog post “40+ Shops, Restaurants, and Amenities Near Eglinton and Victoria Park at Bartley Towns” to learn more about the many amenities close to home in this family-friendly neighbourhood.

Neighbourhood Walk Score

The neighbourhood also has a strong bike score of 57, an excellent walk score of 69 and a solid transit score of 68. Residents will benefit from the brand new LRT, which is scheduled to be completed by May 2022 (well before Bartley Towns move-ins begin). The Eglinton Crosstown LRT’s development and construction represents an $8.4 billion investment and is set to be a major Toronto transportation artery in the near future. Victoria Village residents can also take advantage of the 24-hour bus service along Victoria Park Avenue, which connects to the Bloor-Danforth subway line.

Explore this family-friendly Toronto neighbourhood further.

This prime location makes Bartley Towns a great community to invest in.

Quality

When investing in a real estate property, quality is also a key consideration. Choosing a house or townhouse built by a reputable builder with a long history of excellence is a safe choice to make sure you get the most value for your investment.

BAZIS has a long reputation of designing luxurious living spaces with the utmost attention to detail. Being able to successfully combine visionary architecture and design with marketing and construction has turned BAZIS into a reckoning force in pronouncing the city’s landscape.

The company is known for the unique architecture and high standards of luxurious finishes of its various residences. Knowing that each of BAZIS’ developments is crafted with exquisite design, superior location and elaborate amenities will give you peace of mind.

Potential

The potential of an area is also important, because you want to make sure that your investment will increase exponentially over time. While Victoria Village is an established community, it also has heaps of potential as it’s undergoing a period of major growth and revitalization. Nearby Eglinton Square is going through a major redevelopment, the brand new Eglinton Crosstown LRT is under construction and set to open in 2022, and the stretch along Victoria Park Avenue is undergoing a major period of commercial revitalization.

Bartley Towns’ Grand Opening Is This Weekend!

Bartley Towns represents a great investment opportunity and offers beautiful townhouses in a prime location that your family will love. The community is now open for sale, but act fast as there are just 84 townhomes available.

Interested in learning more about Bartley Towns? Explore our website to discover the home designs, explore the beautiful features and finishes, and to book your private appointment with our sales team today. You can also contact our sales rep John Ly at info@bartleytowns.com or 416-639-8788 if you would like to make a virtual or in-person private appointment at our Sales Office (located at 250 Shields Court, Unit 1, in Markham). Signing of documents is available via DocuSign or in person. Deposits can be made via wire transfer or by bringing cheques to our Sales Office.

Make sure to follow BAZIS on social media (Facebook, Twitter or Instagram) for more news, info, and the latest updates on Bartley Towns and other communities.

Bartley Towns’ Exclusive Opening Is Here

The long-anticipated launch of BAZIS’ newest Toronto townhome community, Bartley Towns, is finally here!

Ideally located at Eglinton and Victoria Park within an established residential neighbourhood that’s also in the midst of a commercial and residential revitalization, Bartley Towns is the family-friendly Toronto community that many residents have been eagerly awaiting. What’s more, it’s an incredible neighbourhood to invest in.

Many Toronto residents have spent the last 16 to 17 weeks in some degree of isolation due to the COVID-19 crisis, and during this time have looked around the place they live and realized that they’re in need of a change. The new townhomes at Victoria Park and Eglinton, Bartley Towns, offer just that.

With access to the DVP north and south highway immediately adjacent to Bartley Towns as well as easy access to the new Eglinton LRT, the community is perfectly situated. The townhomes also offer incredible designs, beautiful finishes, and limited time exclusive incentives.

The Toronto Real Estate Market Is as Strong as Ever

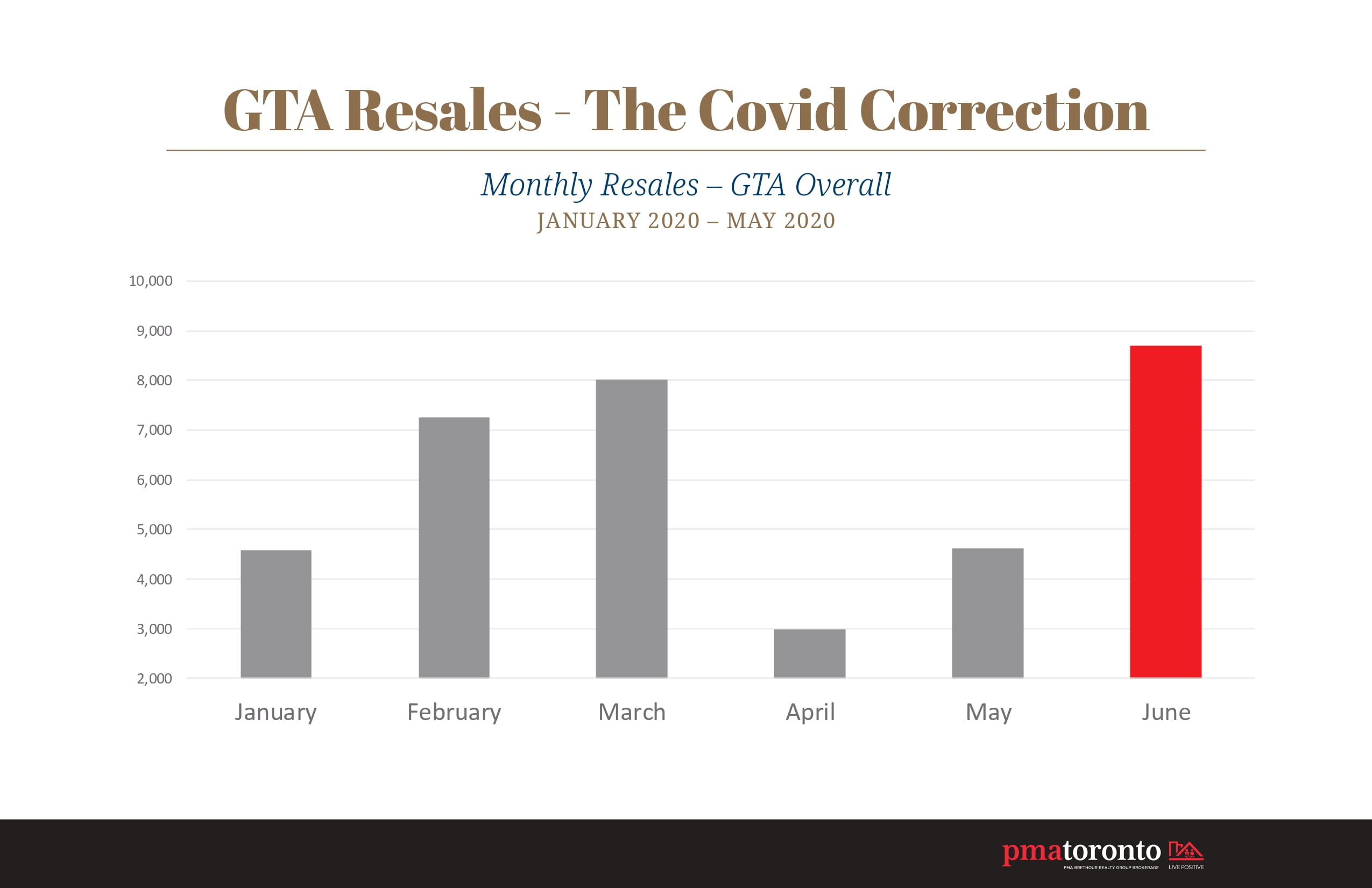

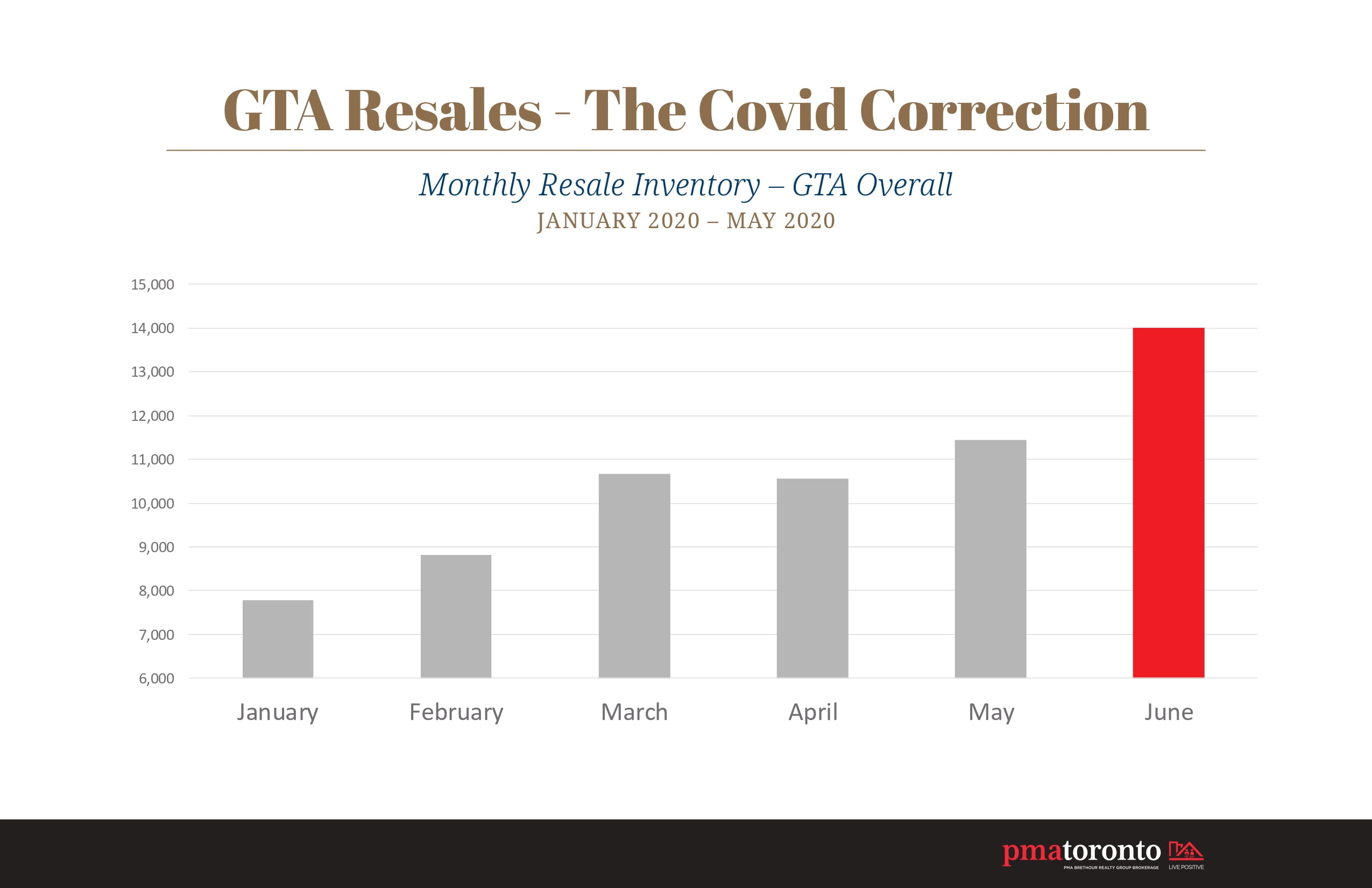

In July 2020, we’re currently in the midst of what is really, for many, a surprising recovery in terms of the Toronto real estate market. In the past few months, we’ve seen a slow and steady recovery, with each month doubling the sales results of the previous month. June sales levels were back up to what would be expected pre-pandemic.

Post-COVID-19 Real Estate Market Recovered

With 8,700 resales last month, the real estate market shows that it has bounced back to the numbers that would be expected during normal times. These resales cover all product ranges and types, particularly townhomes, which have seen very strong demand and growth.

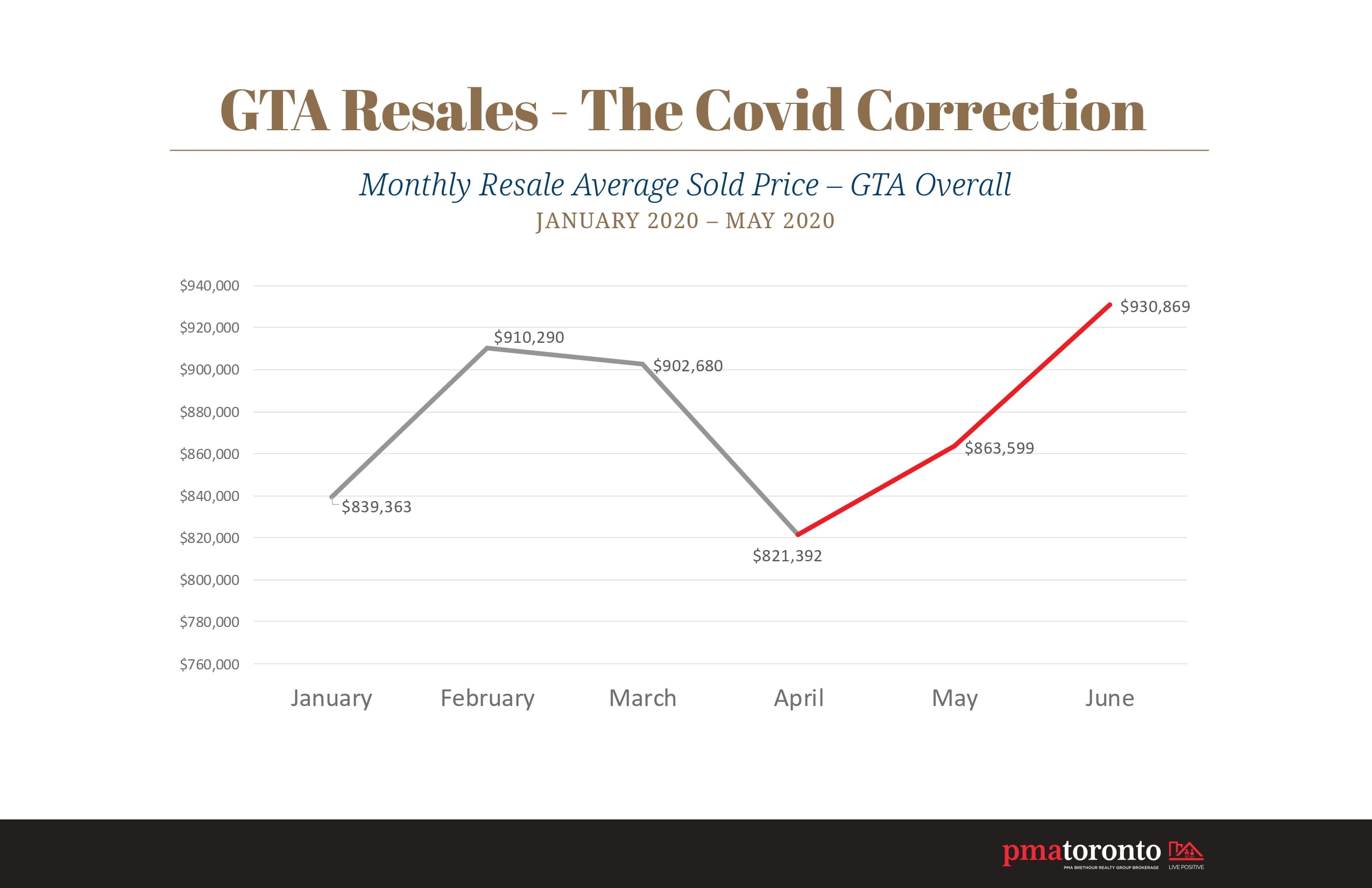

Pricing, too, has bounced back. Prices have risen between 10-14% the past month, reflecting the tight supply and high demand.

These numbers show that consumers are ready to buy. Although they’ve been sitting on the sidelines watching how the pandemic plays out, they’re now ready to jump into the market and buy. If you’ve been considering buying a new home or townhome in Toronto, now is the time to act – especially since supply is low and builders like BAZIS are now offering special incentives.

BAZIS: Rewriting Toronto’s Urban Story

BAZIS has a long reputation of designing luxurious living spaces with the utmost attention to detail. Being able to successfully combine visionary architecture and design with marketing and construction has turned BAZIS into a reckoning force in pronouncing the city’s landscape.

As a company, we’re known for creating contemporary luxury condominiums and homes located in prime neighbourhoods throughout Toronto.

“At BAZIS, we pride ourselves on design, quality and the prime locations of our projects,” says Veronika Belovich, Vice President of BAZIS.

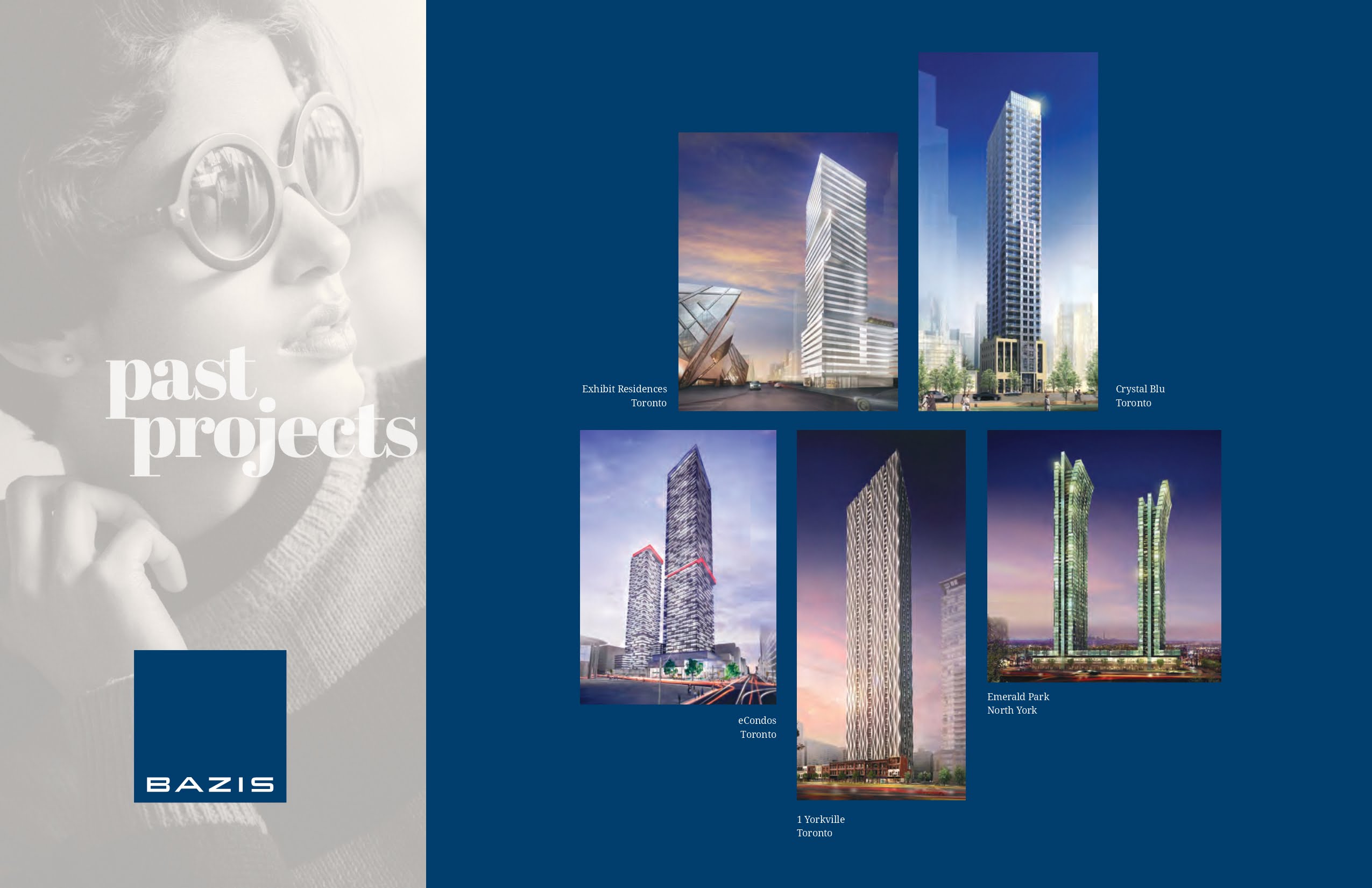

Unique architecture and high standards of luxurious finishes are reflected in past and present projects which include Bartley Towns, Crystal Blu, Emerald Park, Exhibit, eCondos and 1 Yorkville. Each of these developments is crafted with exquisite design, superior location and elaborate amenities.

Welcome to the Neighbourhood

Bartley Towns is perfectly situated to meet the growing needs of today’s modern families. The townhome community is located on Victoria Park just a bit south of Eglinton and just east of the DVP, 600 metres to the Sloane LRT stop and about a 10-minute walk to Eglinton Square (which is going through a major redevelopment). Just beyond that, the famous Golden Mile has a Walmart, Joe Fresh, shopping, schools, restaurants and more.

Bartley Towns is located close to numerous public and private schools, libraries, community centres and parks with ample green space and walking trails.

Toronto’s newest townhome development has it all, including movie theatres, museums, grocery stores, and several public transit options.

Eglinton and Victoria Park Amenities

Check out our blog post “40+ Shops, Restaurants, and Amenities Near Eglinton and Victoria Park at Bartley Towns” to review a sampling of the existing amenities in this family-friendly neighbourhood.

The neighbourhood boasts 55 restaurants, bars and coffee shops in Victoria Village, and Bartley Towns has 17 schools within a 20-kilometre radius. It has a bike score of 57 – it’s minutes away from the safest and most enjoyable biking trails in the City of Toronto.

The community also has a strong walk score of 69 – leave the car at home and walk to shopping malls, restaurants and entertainment.

Bartley Towns’ strong transit score of 68 exists in part because residents will benefit from the brand new LRT, which is scheduled to be completed by May 2022 (well before Bartley Towns move-ins begin). The Eglinton Crosstown LRT’s development and construction represents an $8.4 billion investment and is set to be a major Toronto transportation artery in the near future. The LRT’s speeds average 28 kilometres per hour, which is up to 60% faster than travel now.

An Exclusive Collection of Just 84 Townhomes

The exquisite collection of just 84 townhomes are all freehold townhomes, which means that you own the home itself.

The townhomes share a common element – the roadway – and so there is a monthly maintenance fee, although it is very low at just $113.95/month.

Home Designs and Floor Plans to Suit Your Lifestyle

Bartley Towns’ home designs are ready to be explored. Elegant brick, stucco, and accent details are meticulously brought together in an interplay of delicate colours and timeless proportions. Expansive and refined windows frame park views from the inside, and charming front yard landscapes embellish your clean and sophisticated front entrance.

The floor plans are primarily 4-bedroom homes, with some having the option to go to 3 or 5 bedrooms. The homes feature multiple balconies and a lot of flex space so you can live in style and enjoy your time at home, every day. Flex space such as a den or home office allows you to customize your home to suit your lifestyle. The kitchen and family room are designed in an open-concept fashion, with different options available to give you various configurations, so you can choose the layout that suits you best.

The floor plans feature large bedrooms and bathrooms, with the option of turning one of the bedrooms into a more open-concept family living space if you only need 3 bedrooms instead of the standard layout of 4 bedrooms. Explore the 7 distinctive floor plans.

Luxurious Features and Finishes

Bartley Towns’ thoughtfully planned open-concept layouts are developed to complement your family’s desires and needs, making your home a distinct expression of your personal taste and style. Building on this, the homes feature luxurious finishes inside and out.

Distinct finishes include tall 9’ ceilings on every single floor, high performance laminate flooring on lower and main levels, beautiful natural-finished oak staircases, elegant quartz kitchen and bathroom countertops, ceramic tile kitchen backsplashes, framed glass showers, and much more.

The community features special incentives as well as an extended deposit structure, so get in touch with our sales team ASAP to take advantage of these limited time offerings (not detailed above).

Book Your Appointment Today

Please contact our sales reps John Ly and Nassim Heshami at info@bartleytowns.com or 416-639-8788 if you would like to make a virtual or in-person private appointment at our Sales Office (located at 250 Shields Court, Unit 1, in Markham). Signing of documents is available via DocuSign or in person. Deposits can be made via wire transfer or by bringing cheques to our Sales Office.

Bartley Towns’ move-in dates (closing dates) are scheduled for January 2023, and construction is set to begin in the spring of 2021.

Visit the Bartley Towns page to discover the home designs, explore the beautiful features and finishes, and to book your private appointment with our sales team today. And make sure to follow BAZIS on social media (Facebook, Twitter or Instagram) for more news, info, and the latest updates.

Everything You Need to Know About Toronto’s 2020 Real Estate Market Forecast

With Canada’s national housing supply being at the lowest levels seen in 12 years according to the Canadian Real Estate Association (CREA) and home sales rising 0.6% nationally from October to November 2019 (for the ninth straight month of increases), it’s clear that the Canadian housing market is on fire. Continue reading