2019 Federal Budget Provides Incentives

A recent budget released by the feds may make buying a home a little easier for first-timers. Buying a home remains a solid investment in the future and millennials want to gain a foothold in the marketplace. This is particularly true in Canada’s biggest cities, including Toronto.

While the incentive doesn’t hit all buyers in all tax brackets, it can have a positive effect on the entire Toronto housing market by opening it up for more people to buy.

The recent budget proposal features a new incentive, the CHMC First Time Homebuyer Incentive and would cost the federal government up to $1.25 billion over the next 3 years. The incentive offers relief to qualified first time home buyer households and will provide assistance without adding a further burden.

Here’s a breakdown of the First Time Homebuyer Incentive proposal:

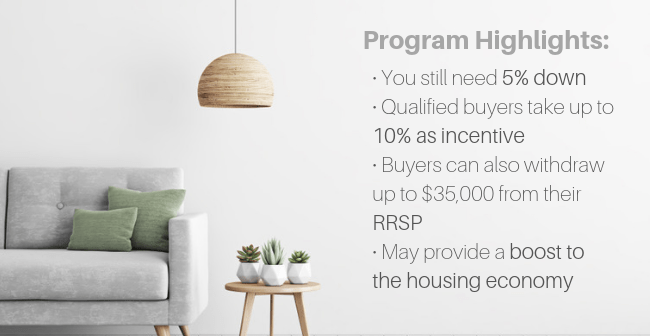

- Buyers must still put down the minimum of 5% downpayment on a home

- Additionally, buyers of new homes can qualify for an incentive worth up to a further 10%

- Households with an income less than $120,000 are eligible

- Only homes that are within the limit of four times the household income are insurable under this plan (approximately $500,00)

This has the effect of lowering the overall mortgage cost and can reduce payments. Applicants must still undergo the typical mortgage stress testing, however, the lowered payments can help with the approval process.

Canada’s Home Buyers Plan

Under current rules, homebuyers can only withdraw up to $25,000 from their RRSP to purchase their first home. The federal government is also proposing to increase this limit to $35,000, allowing home buyers to put a larger down payment on their home. This will effectively further decrease mortgage costs.

It is important to note, however, that the RRSP contribution must be repaid in full within 15 years of borrowing.

The good news is that even if the home you’re targeting is valued at more than the cap, or your income is too high to qualify, this gives first-timers the ability to join the market and we think it could give an overall boost to the housing industry and stimulate the growth of housing in the GTA.

For more information on buying a new home in the GTA at 1 Yorkville, or at Bartley Towns, stay tuned by registering or following us.