The GTA real estate market faced mixed conditions in August 2024. While home sales were down compared to the same time last year, there was a slight increase in new listings. The average home prices also dropped a bit, with affordability remaining a concern for buyers. This shift was driven by economic factors such as interest rate changes, market supply, and varying demand across property types.

Sales and Price Trends

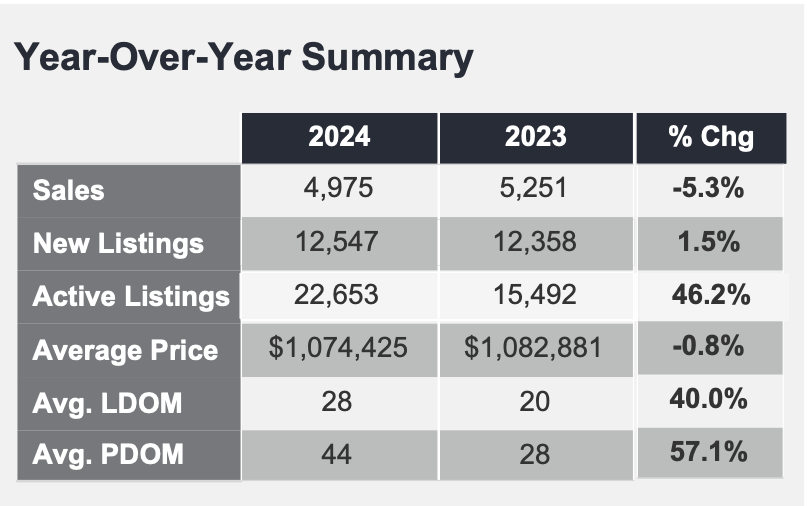

In August 2024, according to the Toronto Regional Real Estate Board (TRREB), GTA REALTORS® reported 4,975 home sales, which is 5.3% less than the 5,251 sales in August 2023. New listings increased by 1.5%, with 12,547 added to the MLS® System. TRREB President Jennifer Pearce noted that the recent rate cut by the Bank of Canada will improve affordability, particularly for buyers with variable-rate mortgages. She mentioned, “First-time buyers are especially sensitive to changes in borrowing costs. As mortgage rates continue to trend lower this year and next, we should experience an uptick in first-time buying activity, including in the condo market.”

The average home price in the GTA dropped by 0.8% from last year, and is now at $1,074,425. This small decrease shows that the region has plenty of housing available. However, the larger 4.6% drop in the MLS® Home Price Index is because more detached homes were sold, which affects the average differently.

Image: TRREB

Jason Mercer, TRREB Chief Market Analyst, provided more context: “As borrowing costs trend lower over the next year-and-a-half, home buyers will initially benefit from both lower monthly mortgage payments and lower home prices. Even as demand picks up, especially in 2025, it will take time for the inventory of listings to be absorbed.”

Affordability Challenges and the Impact of Interest Rates

While interest rate cuts are helping, affordability is still a challenge in Toronto. The Bank of Canada’s rate cut on September 4, 2024, was good news for homebuyers, but experts say more cuts will be needed to really improve affordability. Luckily, markets expect another rate cut in October and one more in December, which could lower interest rates to 3.75% by the end of the year, making financing even easier for buyers.

REMAX reported that from January to July 2024, the average sale price for all property types in Toronto went up by 0.5%, but sales dropped by 5.4%. Even with more homes listed, first-time buyers still struggle with affordability. REMAX noted in a market report: “Interest rates will have to fall further to create the affordability necessary for many buyers, particularly first-timers.”

This sentiment is echoed by RBC, that even though interest rates are dropping, many Canadian homebuyers are still reluctant to enter the market. Slow economic growth and higher unemployment have lowered consumer confidence. With inventories now covering 4.1 months of sales nationwide, buyers have more room to negotiate, which is helping to stabilize prices.

Fall Market Outlook

Looking ahead to fall, there’s hope for more buyer activity. Zoocasa’s Fall 2024 Housing Market Predictions suggest that increased inventory and lower interest rates could lead to a busy market. However, Zoocasa warns that while prices might seem lower, competition for popular homes, especially in top school districts, will still be tough.

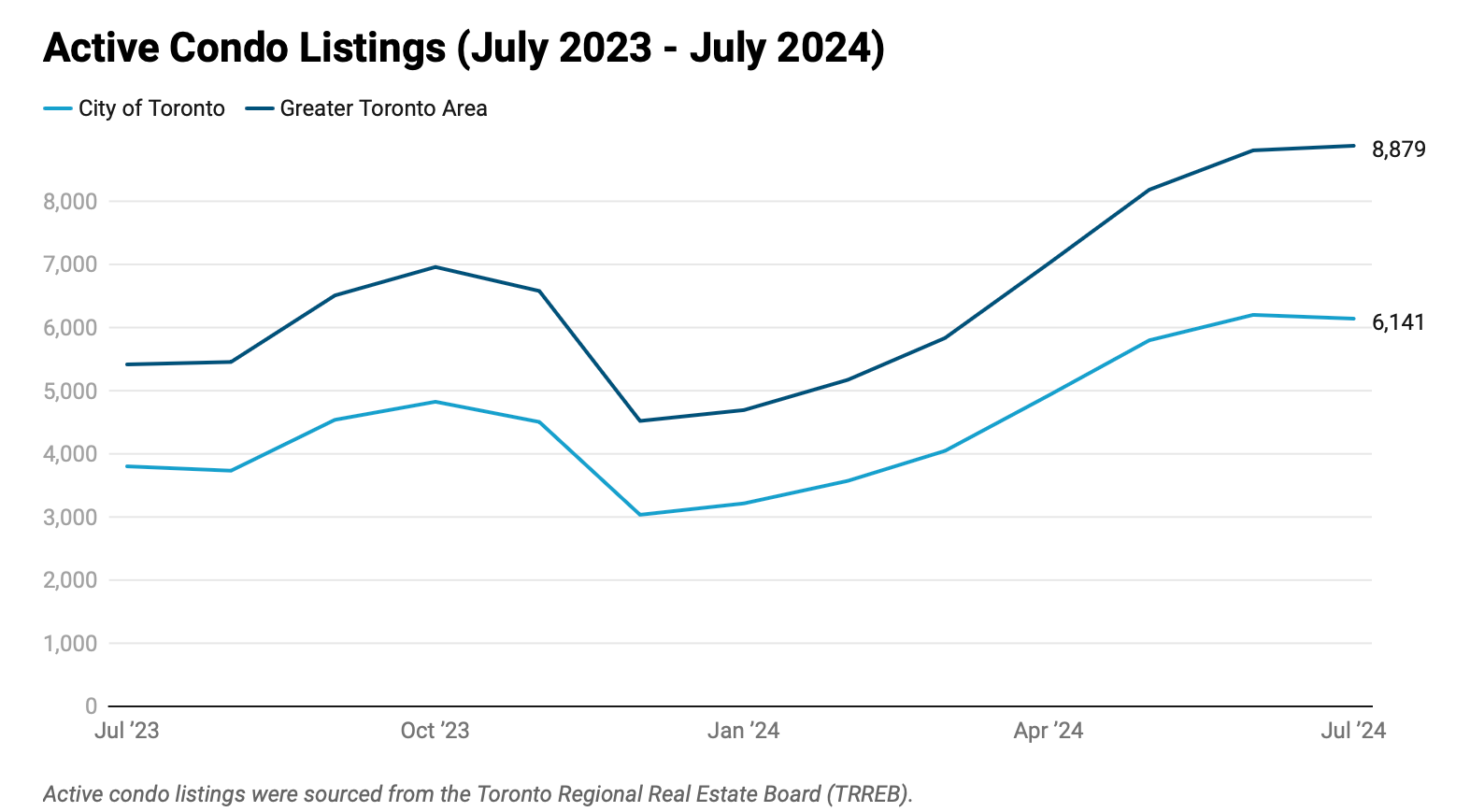

“We’re seeing condo inventory reach unprecedented levels, driven by a surge in newly registered buildings, many of which are investor-owned,” said Zoocasa’s Lauren Haw. The larger supply of condos, especially in Toronto, could cause prices to drop further, giving buyers more options and better negotiating power.

Image: Zoocasa

In August 2024, the Toronto housing market showed mixed trends – sales were down, listings were up, and home prices were fluctuating. However, expected interest rate cuts could boost buyer activity, bringing some hope. While affordability remains a challenge, especially for first-time buyers, the outlook for 2025 looks positive with lower borrowing costs and better inventory levels. As fall approaches, buyers can anticipate new opportunities as the market stabilizes, creating a more balanced environment for those ready to buy.

What are your predictions for Toronto’s fall real estate market? Connect with BAZIS on social media (Facebook, X, or Instagram) and let us know!