Do New Development Condos in Toronto Allow Airbnb Rentals?

Airbnb is a popular accommodation option for travellers in Toronto. It’s estimated that there are over 8,000 listings on the site, and this number continues to grow each year. As an Airbnb host, there are many benefits to listing your property on the site. It’s a great option, for example, if you’re looking for a change in careers, trying to make passive income, wanting to become your own boss, or looking to rent out your home while you travel or are away for work. It sounds great if you already own a property, but what if you’re in the market for a new condo? Do new development condos in Toronto allow Airbnb rentals? Read on to find out more.

What Is Airbnb?

Airbnb is a website that connects people who have extra space in their homes with people who want to stay there. Airbnb hosts rent out their private rooms or entire homes, often at lower rates than hotels and other lodging options. Airbnb has become popular in recent years because it allows users to travel more affordably while getting a unique experience staying in someone else’s home.

Know the Regulations

The impact of Airbnb on new development condos is one that should be considered by developers and homebuyers alike. The rise in popularity of short-term rentals has resulted in a decrease in available long-term rental units, as well as an increase in competition for available units. While the city continues to grapple with an affordable housing crisis, the City of Toronto amended their short-term rental rules and regulations in November 2019 to dissuade investors from purchasing properties for the use of short-term rentals alone. The new short-term rental rules are such that you can short-term rent your home only if it’s your principal residence. This is the residence where you live and the address you use for bills, identification, taxes and insurance. You can only have one principal residence at a time, so therefore you cannot legally run more than one short-term rental. You can rent up to three bedrooms in your principal residence for an unlimited number of nights per year or the entire home for a maximum of 180 nights per year. Your home must be in a residential area in the city, and you must be registered with the City.

Do New Development Condos Allow Airbnb Rentals?

The short answer is that it depends.

Because of the new rules and regulations, you can only operate an Airbnb out of your principal residence, meaning it’s not a viable option for condo investors who are interested in purchasing property for the sole purpose of renting it out as a short-term rental. That being said, if your plan is to live in your unit and rent it out under the new short-term rental rules and regulations, then there are a number of factors to consider before buying into a pre-construction condo.

One of the most important considerations is whether or not Airbnb rentals are allowed in the building. The restrictions on Airbnb rentals vary from condo to condo, and range from no restrictions at all (for example, some buildings allow short-term rentals year-round) to very few nights allowed per year (for example, only one weeknight per month) to none permitted at all. Condo boards can also place restrictions based on unit type or floor level; for example, some buildings allow only penthouse owners to rent out their units as short-term rentals while others allow any owner who lives in their unit full-time to do so.

Before purchasing a property for short-term rentals such as Airbnb, it’s important to check the preliminary bylaws and ensure that they permit this type of rental. However, it’s worth noting that some developments may prohibit short-term rentals once residents move in. In certain situations, it may be possible to persuade the developer to include grandfather clauses for short-term rentals. Nevertheless, it’s advisable to consult a real estate lawyer before making any decisions.

If you’re looking to rent out your condo on Airbnb, there are a few things you should keep in mind. Make sure that the building allows short-term rentals and has an agreement with Airbnb or another service like it. Many buildings have restrictions against short-term rentals because they want to maintain a sense of community among residents and discourage transient use by people who may not be invested in the building’s success. If you’re considering renting out your unit through Airbnb, ask about these policies before making any decisions about whether or not it’s right for you.

Do you have any questions about new development condos and Airbnb? Connect with BAZIS on social media (Facebook, Twitter or Instagram) and let us know!

Making a Smart Investment: Comparing Pre-Construction Condos and Resale Properties

The Toronto real estate market is always evolving, and as a potential homebuyer, it can be challenging to decide which type of condo to invest in. While resale properties offer established communities and a record of previous sales, pre-construction condos promise the latest in modern design and technology, often stellar locations, and many other benefits. In this blog, we’ll explore the pros and cons of each option to help you decide which type of condo is the right investment for you.

Pre-Construction Condos

Pre-construction condos are properties that are still in the planning and construction phase, as the name suggests. These units offer buyers the opportunity to enter the real estate market at a more gradual pace, as the buyer typically pays a deposit of 5-15% over a period of time, with the remaining down payment due at the completion date, which is typically about 2-5 years later.

Pre-construction condos usually feature the latest advancements in modern design and technology, making them appealing to prospective buyers or renters. Furthermore, these condos are usually situated in emerging neighbourhoods, which can lead to higher appreciation potential over time as the area becomes more desirable. Many condos are also built in prime locations, however, to help intensify cities.

Investing in a pre-construction condo has several significant advantages. Firstly, buyers can secure the property at the lowest price without having to participate in bidding wars. Additionally, buyers can customize the unit according to their preferences, such as choosing the appliances, finishes, and layout that best serve their needs. Furthermore, pre-construction condos come with warranties, which can provide reassurance in case of any unforeseen issues.

Despite their benefits, pre-construction condos present their own set of challenges. One potential challenge is the risk of construction delays, which can affect your ability to move in, generate rental income, or sell the unit. Since pre-construction condos require time to build, you must have a good understanding of what your future might look like in a few years. For example, how much space will you need? Are you planning to expand your family? Additionally, since pre-construction condos are not yet constructed, you cannot inspect the unit before purchasing, which can be a disadvantage for those who prefer to see the space before making a decision.

Resale Properties

Resale properties are homes that have been previously owned and are now being sold by their current owner. These condos are typically located in established communities, offering a sense of stability and history. Resale properties are oftentimes larger than pre-construction condos, offering more space for families or those looking for a little extra room.

One of the primary advantages of investing in a resale is the ability to see the property before you buy. This means that you can inspect the home for any potential issues and get a feel for the space and layout. You can also research the property’s history, including previous sales and any issues that may have arisen.

Another benefit of investing in a resale property is the ability to move in right away and the potential for immediate rental income. Since these units are already built and ready to occupy, you can start renting them out right away. This can help you earn a return on your investment more quickly than waiting for a pre-construction unit to be completed.

Despite their benefits, resale homes present their own unique challenges. One of the main concerns is the age of the property, which may require more frequent maintenance and repairs. Additionally, since these properties have already been owned, they are not as customizable and may not feature the latest advancements in modern design and technology. This can have an impact on the property’s appeal to potential tenants or buyers. Furthermore, purchasing a resale property typically requires a significant amount of money upfront, as the down payment is usually around 20% of the property’s value.

Which Type of Condo Should You Invest In?

When choosing which type of condo to invest in, it’s crucial to consider your objectives, preferences, and financial position. If you want immediate rental income, quick occupancy, or a sense of community, a resale property may be the better option. However, if you’re searching for a new unit that you can tailor to your liking and the potential for appreciation over time, a pre-construction condo might be more suitable. You must also assess your finances and determine which option is most suitable for you. Can you afford a down payment of 20% or more right now, or do you need some time to make your payments?

Additionally, the location of the unit is critical to consider since it can influence its appeal and potential for rental income and appreciation over time. Seek out units situated in sought-after neighbourhoods with convenient access to public transit, shopping, and entertainment options.

Ultimately, the decision of whether to invest in a resale or pre-construction condo comes down to your personal goals and preferences. Do your research, weigh the pros and cons of each option, and make an informed decision that aligns with your investment strategy.

Do you have any questions about resale or pre-construction condos? Connect with BAZIS on social media (Facebook, Twitter or Instagram) and let us know!

The Most Common Mistakes of Pre-Construction Condo Buyers

Buying a pre-construction condo in downtown Toronto in 2023 can be an exciting opportunity. Investing in a pre-construction condo in Toronto gives you access to the best units at the lowest pricing, not to mention a brand new home that you get to customize to your liking! Pair that with an excellent neighbourhood and a reputable builder, and you’ve got yourself a slam-dunk. Purchasing a pre-construction condo is not only a great life choice, but also a lucrative investment if you choose to rent or sell later.

While the rewards are plenty, it’s essential to proceed with caution when investing in a pre-construction condo in Toronto. The process can be long and confusing, and if you don’t take care you can end up paying for it with your wallet or your sanity (or both!). We’ve put together a list of the most common mistakes of pre-construction condo buyers so that you can be empowered when making your purchase and enjoy the experience from start to finish.

Mistake #1: Not Getting Professional Advice

One of the biggest mistakes pre-construction condo buyers make is trying to cut costs and navigate the buying process alone. The process of buying a pre-construction condo in Toronto is complex. Before signing any legally-binding contracts, you’ll want to consult an experienced real estate agent, lawyer, and mortgage broker. There are many details to iron out before making major life decisions. These professionals can help you navigate your rights and responsibilities as a condo owner by helping you understand the terms and conditions of your contract. Additionally, they can advise you on the legal aspects of your purchase agreement and your financing options. They’ll also be able to spot any red flags or concerns on your behalf, and ensure that everything goes smoothly and that there are no surprises.

Mistake #2: Not Having a Pre-Approved Mortgage

One of the biggest blunders of purchasing a pre-construction condo in Toronto is when buyers make the assumption that they’ll qualify for a mortgage. Most pre-construction condo projects take years to complete, and your life circumstances can drastically change in that time. You may be eligible for a mortgage now but that might not be the case down the road. Before closing your deal, get in touch with a mortgage broker and make sure you qualify for a pre-approved mortgage.

Mistake #3: Not Planning for Closing Costs and Other Fees

Buying a pre-construction condo requires a considerable amount of financial planning. Many condo buyers look at the price tag without realizing that they’ll also be required to pay additional fees – for example land transfer taxes, registration fees, and legal fees. If you’re not prepared, these costs can quickly add up and become overwhelming. So, before making any decisions, you’ll want to ensure you’re aware of all the costs related to your pre-construction condo. Consider hiring a real estate broker who can help you understand your deposit structure, maintenance fees, property taxes, and closing costs. You’ll also need to factor in additional costs like the monthly interest rate on your mortgage (which can change over time), insurance fees, utility bills, and parking fees.

Mistake #4: Not Planning for the Future

Buying a pre-construction condo means buying a home that hasn’t been built yet. On average, it takes three to five years for a pre-construction project to be completed, depending on its size and complexity. It’s common for builders to face setbacks and delays in construction, which means that the time to complete the project and occupancy is unpredictable. Many buyers purchase their homes with their current lifestyle in mind, but when it comes to pre-construction condos, you need to consider where you’ll be in a few years. You’ll want to factor in potential life changes that may occur – for example, what if you end up having a child and a one-bedroom condo isn’t enough space? Before signing any contracts, think about your future and plan ahead.

Mistake #5: Expecting the Floor Plans to Stay the Exact Same

Many people fall in love with floor plans and renderings shown in marketing brochures without realizing that things can change. This can lead to disappointment when the finished condo isn’t exactly what they had imagined. It’s important to understand that when purchasing a pre-construction condo, you’re buying into the builder’s vision before construction begins. During the construction phase, it’s not uncommon for the initial floor plans to change slightly, either to create more space or to accommodate different features. The best way to combat disappointment is to ensure you’re working with a good builder who’s known to deliver quality results, and be ready to work with a flexible floor plan.

Do you have any questions about the pre-construction condo buying process? Connect with BAZIS on social media (Facebook, Twitter or Instagram) and let us know!

BAZIS is a real estate development company specializing in developing communities and pre construction condos in Toronto area. We’re committed to excellence in every facet of the commercial and residential real estate development process. Combining visionary architecture, design, marketing and construction with the epitome of corporate integrity and environmental responsibility, BAZIS has become a major force in articulating Toronto’s ever-evolving skyline.

Buying a Pre-Construction Condo in Downtown Toronto: Do You Have to Pay HST?

Buying a brand new pre-construction condo in downtown Toronto is exciting, but it may also bring up many questions and uncertainties. It can be confusing trying to understand how HST works, for example, and who pays for it. So, let’s break down HST when purchasing a pre-construction condo in Toronto and take a closer look at the HST Rebate.

In 2010, Ontario implemented Harmonized Sales Tax (HST), which raised the tax on new homes to 13% (HST) – a total of 5% GST (federal taxes) and 8% PST (provincial taxes). To help new homeowners cover the growing costs of owning a new home, the government created the HST Rebate Program. This program works in two ways – depending on what kind of buyer you are – to reimburse buyers for a portion of the tax.

The two ways that buyers can qualify for the HST Rebate in Ontario are:

- HST New Home Rebate (NHR): When you buy a pre-construction condo that you plan to live in (end user)

- New Residential Rental Property Rebate (NRRPR): When you buy a pre-construction condo as an investor with the intent of renting it out after closing (investor)

End Users

When you buy a pre-construction condo in Downtown Toronto, you’re assigning the right to the HST rebate to the builder. The builder then uses the rebate to reduce the purchase cost of the property. This portion of the HST is not added to your property’s purchase price, and the builder will apply for the HST rebate for the property, thus reducing the amount due at closing by the amount of the rebate.

In short: you don’t have to pay for HST on your new condo, as it’s already built into the final purchase price of the home, including the cost of the HST NHR. This is provided you’re a Canadian resident and provided that you, or an immediate family member such as a parent or sibling, plan on being the principal resident of the condo.

One thing to keep in mind is that if you sell or lease the property before the one-year mark, the Canada Revenue Agency (CRA) will require you to pay back the HST Rebate in full.

Investors

If you plan on purchasing a pre-construction condo for sale in Downtown Toronto with the intent of renting it out after closing, you need to apply for the New Residential Rental Property Rebate (NRRPR) rather than the NHR.

To receive the HST Rebate, you need to submit a one-year lease agreement and prove that the property will be rented out for one year after closing. Additionally, you must pay the full HST amount upfront and you will receive the rebate a couple of months after sending in the proof of the lease agreement. Similarly to the NHR, if you end up selling or flipping the property before the one-year mark, the CRA will require that you pay back the HST Rebate in full.

How Much Is the HST Rebate?

The amount of the HST Rebate varies depending on the price of the new condo. If the pre-construction condo is priced under $350,000, then you’re eligible to receive a maximum of $30,000 back (36% rebate on the GST portion, and 75% on PST). Between $350,000 and $450,000, there is a sliding scale, and for properties costing more than $450,000, a maximum rebate of $24,000 can be received.

There are many HST Rebate calculators on the internet that you can consult to calculate the exact amount, but keep in mind that if you’re purchasing a pre-construction condo and plan to live in it, the HST in the majority of cases will already be factored into the purchase price, and you don’t need to worry about it.

Do you have any questions about HST when buying a pre-construction condo in Toronto? Connect with BAZIS on social media (Facebook, Twitter or Instagram) and let us know!

BAZIS is a real estate development company specializing in developing communities and pre construction condos in Toronto area. We’re committed to excellence in every facet of the commercial and residential real estate development process. Combining visionary architecture, design, marketing and construction with the epitome of corporate integrity and environmental responsibility, BAZIS has become a major force in articulating Toronto’s ever-evolving skyline.

With High Interest Rates, Is It Still a Good Time to Buy a Pre-Construction Condo?

Interest rates have risen dramatically in Canada recently, putting pressure on Canadians who have (or are hoping to acquire) a mortgage, line of credit, or other loans with variable interest rates. Since March 2022, the Bank of Canada has raised interest rates six times, and rates have shot up from 0.25% to 3.75% (source). High interest rates mean that it now costs Canadians more to borrow money, and they’re leaving many people wondering if now is a good time to buy a pre-construction condo in Toronto and to enter the housing market.

While the higher mortgage costs are leaving many Canadians feeling anxious and frustrated, we believe that it is still a good time to buy a pre-construction condo in Toronto or the Greater Toronto Area (GTA). Here’s why:

The Increasing Value of Pre-Construction Condos

Buying pre-construction means that your new condo won’t be ready for approximately three to five years from the date of purchase. In most cases, the value of the condo increases from the time it’s finished without the owner having to do any work or upgrades. And given the rate at which Toronto condos appreciate, it’s a smart time to get into the market despite the higher interest rates.

The Lack of Housing Inventory

Toronto has a notoriously low amount of homes available for sale compared to the demand, which we can expect to continue to drive higher prices in the GTA. As such, it’s best to get into the Toronto real estate market as soon as you can reasonably afford it.

The Ever-Growing Demand for Housing

On top of the current low inventory, the demand for housing in Toronto is expected to continue to increase. The latest data from Immigration, Refugees and Citizenship Canada (IRCC) reveals that Canada welcomed 274,980 new permanent residents in the first seven months of this year, which puts Canada on track to see immigration hit 471,394 new permanent residents in 2022, or 16.1% more than the record-breaking 406,025 new permanent residents to Canada last year. The country plans to welcome another 477,055 immigrants next year and 451,000 in 2024 (source). The vast majority of these immigrants come to Ontario, including 227,235 newcomers in 2022 (source). In 2021, over 9 in 10 recent immigrants lived in one of Canada’s 41 census metropolitan areas, which are large urban centres of over 100,000 residents. As was the trend over the past 50 years, Toronto (29.5%), Montréal (12.2%) and Vancouver (11.7%) continued to welcome the most recent immigrants in 2021 (source).

With all of this continued growth in Canada, Ontario, and the GTA, the demand for housing shows no signs of slowing down. Every new resident will need a place to live. This will continue to drive up real estate demand and prices. The sooner you can get into the market and secure your investment, the better.

More Bargaining Power for Buyers

The shifting market and turbulence may give new home and condo buyers more leeway to negotiate and more bargaining power, which are valuable things to have on your side when looking for a GTA house or condo to purchase. As the rising interest rates have caused demand for new homes to decrease, buyers who remain in the market will have a greater opportunity to take their time and to be smart and prudent when making important financial decisions. Whether it’s negotiating the price of a new home or condo, or adding conditions to their offer, buyers will have the upper hand in this market. They’re also less likely to have to enter a vicious bidding war.

It’s Important to Play the Long Game

Finally, with real estate, you have to play the long game. The dips and rises of the real estate market and varying interest rates are normal, and there will always be rebounds and corrections. Waiting for the “perfect” time to buy is nearly impossible, so it’s best to buy what you can afford, when you can afford it. Despite the fluctuating market, the long-term growth possibilities are strong. Real estate is a long-term investment strategy and we know from both recent and long-term trends that it always appreciates. In short, real estate is a good investment.

Questions? Comments? Connect with BAZIS on social media (Facebook, Twitter or Instagram) and let us know!

BAZIS is a Toronto real estate development company specialized in new construction condos for sale and pre-construction condos in Downtown Toronto. We are committed to excellence in every facet of the commercial and residential real estate development process. Combining visionary architecture, design, marketing and construction with the epitome of corporate integrity and environmental responsibility, BAZIS has become a major force in articulating Toronto’s ever-evolving skyline.

10 Questions to Avoid Poor Pre-Construction Condo Investments

Buying a pre-construction condo in downtown Toronto is a big decision and financial investment, and you should be informed and confident with the details of your potential new home. In order to get the best possible deal and also a safe investment from a reputable builder and developer, there are several questions you’ll want to consider along the way. The following questions are designed to help guide you through the process of buying a new condo in Toronto and avoid common mistakes that new buyers make.

- Who is the builder/developer and what is their experience? Who is the contractor?

Before purchasing a pre-construction condo, you will want to do some background research on who you’re purchasing from. Who are the condo developer and contractor? Do a quick Google search and see if you can find any potential red flags. If the developer and contractor sound good, check if they have experience building the type of condo and amenities that you’re looking for and that suit your lifestyle. Are they located in the city of your choice and do they have an extensive portfolio? - What can I afford?

In order to determine what unit you can afford, visit the developer’s website or the sales centre of the pre-construction condo you’re interested in. Many developers have affordability calculators on their websites that can help you figure out your budget and down payment, and if not, a sales centre staff member should be able to help you determine which unit is within your budget and what you can afford. You should also be aware of all the costs that come along with a pre-construction condo, including occupancy fees and closing costs. - What is the deposit structure?

Before investing in a pre-construction condo, make sure you know what the deposit structure is. A deposit structure is a payment schedule to pay off your down payment. Sometimes you can negotiate your deposit structure with the builder so that you can make your payments comfortably. - Will my deposit be protected?

The deposit for pre-construction condos in Toronto is typically 20% of the purchase price, although this varies. Even though your deposit is fully protected by the Condominium Act, you should always ask the developer what other security measures they have in place to protect your deposit. When purchasing a pre-construction condo from a respectable builder, your purchase fees should include a Tarion Warranty Corporation enrollment fee that protects your deposit in the case that the project is not completed. - When can I take possession?

Sometimes pre-construction condo projects can be delayed for months, and sometimes even years due to a variety of reasons. Most builders try to honour their commitments but sometimes things happen out of their control. First you will want to ensure that the builder has a good reputation for finishing projects on time, and second you will want to ask if they have a firm date of possession. Protect your investment by asking the condo developer what they will do if your possession date is delayed for any reason. You can also check the developer’s history in Tarion’s Builder Directory before committing to your purchase. - What is the outside date?

An outside date is the date a developer will give you if your pre-construction condo is not completed on time. Consider it as an extension date. Make sure you’re comfortable with this date, and ask the developer if they don’t complete the project on time, what are your options for backing out of your contract. - How many units remain in the building?

This number can tell you a few things – it can tell you how many people are interested in this building, and when construction will begin. If there are a high number of units remaining, it might be a while before the developer has enough capital to begin the construction phase. Then again, if you’re getting in early, you may be getting a better deal.

- How will I know if my condo will meet my expectations?

This again comes back to the reputation of the builder/developer. You need to do your due diligence and make sure the developer has experience and that they have a good track record of delivering on what they promise. Check out their previous condos and see if you like their style. If you purchase from a well-known builder, you shouldn’t have to worry that your condo will end up disappointing you. Another thing to consider is that you really need to know what you’re purchasing. Familiarize yourself with the project’s sales centre, ask questions, and study the floor plans and finishes, as well as the amenities spaces and renderings. Also, make sure that you’re happy with the neighbourhood in which the condo will be built.

- What if I have questions or concerns?

Purchasing a pre-construction condo can be overwhelming but is also very rewarding when you finally move into your unit. Ask the developer about their customer care, and what services they have in place to help you with any questions that may arise. Some developers have extensive customer care practices and will keep you updated on construction updates, occupancy dates and fees, etc. - Who will manage the building?

The builder is responsible for developing the building, selling units and the construction phase of the building, but usually another company is hired to manage the building once construction is complete. Find out who will manage the building and check into their reputation. - What other developments are coming to the area?

Ask the developer if they know of any other builders working in the area, and do a search online. Sometimes another condo development could end up blocking your view or the construction of another tower might make your investment less desirable. Find out what is happening in the neighbourhood.

Do you have any questions about how to avoid poor pre-construction investments? Connect with BAZIS on social media (Facebook, Twitter or Instagram) and let us know!

BAZIS is a Toronto Real Estate Development Company specialized in new construction condos for sale and pre-construction condos in Downtown Toronto. We are committed to excellence in every facet of the commercial and residential real estate development process. Combining visionary architecture, design, marketing and construction with the epitome of corporate integrity and environmental responsibility, BAZIS has become a major force in articulating Toronto’s ever-evolving skyline.

Toronto’s Inclusionary Zoning Policy Aims to Create More Affordable Housing

In November 2021, Toronto City Council adopted a new Inclusionary Zoning policy framework. The City of Toronto is the first city in Ontario to implement inclusionary zoning, which will ensure that more affordable housing is built across the city.

In the last five years, only 2% of housing that has been built or approved in Toronto has been affordable. The areas in Toronto with the largest amount of new housing are also experiencing substantial price escalation to the point where many Torontonians are struggling with housing affordability.

Inclusionary zoning is a tool to ensure that major Toronto neighbourhoods provide housing options that are suitable for a wide range of households and incomes. In the City’s policy, ownership prices will be centred on new income-based definitions of affordable housing, targeting households earning too much for social housing but not enough to afford market prices. These low- to moderate-income households fall in the 30-60 percentile of income distribution. This includes households earning $32,000-$92,000 per year, depending on household size.

Toronto City Council approved an Inclusionary Zoning Official Plan amendment, a Zoning Bylaw amendment and draft Implementation Guidelines, which will make it compulsory for some new developments around Protected Major Transit Stations Areas (PMTSAs) – for example, the TTC – to include affordable rental and ownership housing units beginning on September 18, 2022.

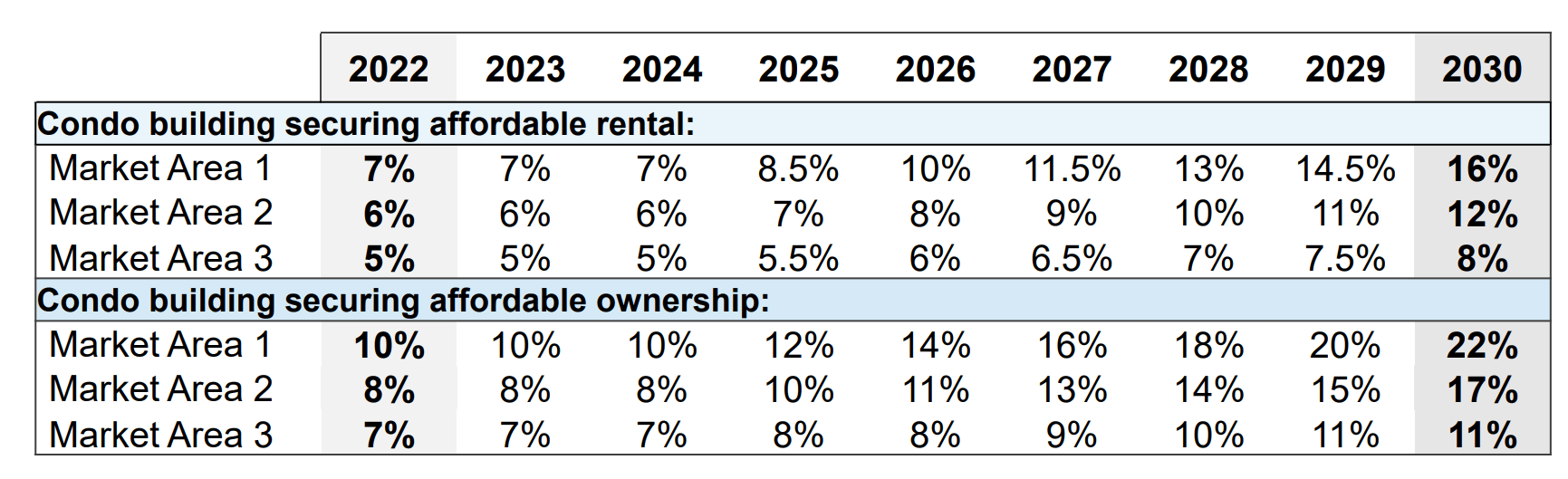

Inclusionary Zoning will secure 5-10% of certain condominium developments (the development must have at least 100 units, and have over 8,000 sq. ft. of residential gross floor area to qualify) as affordable housing, increasing gradually to 8-22% by 2030. The amount of affordable housing will vary depending on where the development is located in the city and whether the units are intended for ownership or rental. The highest requirements for affordable housing will be in the Downtown Toronto area, followed by Midtown and Scarborough Centre.

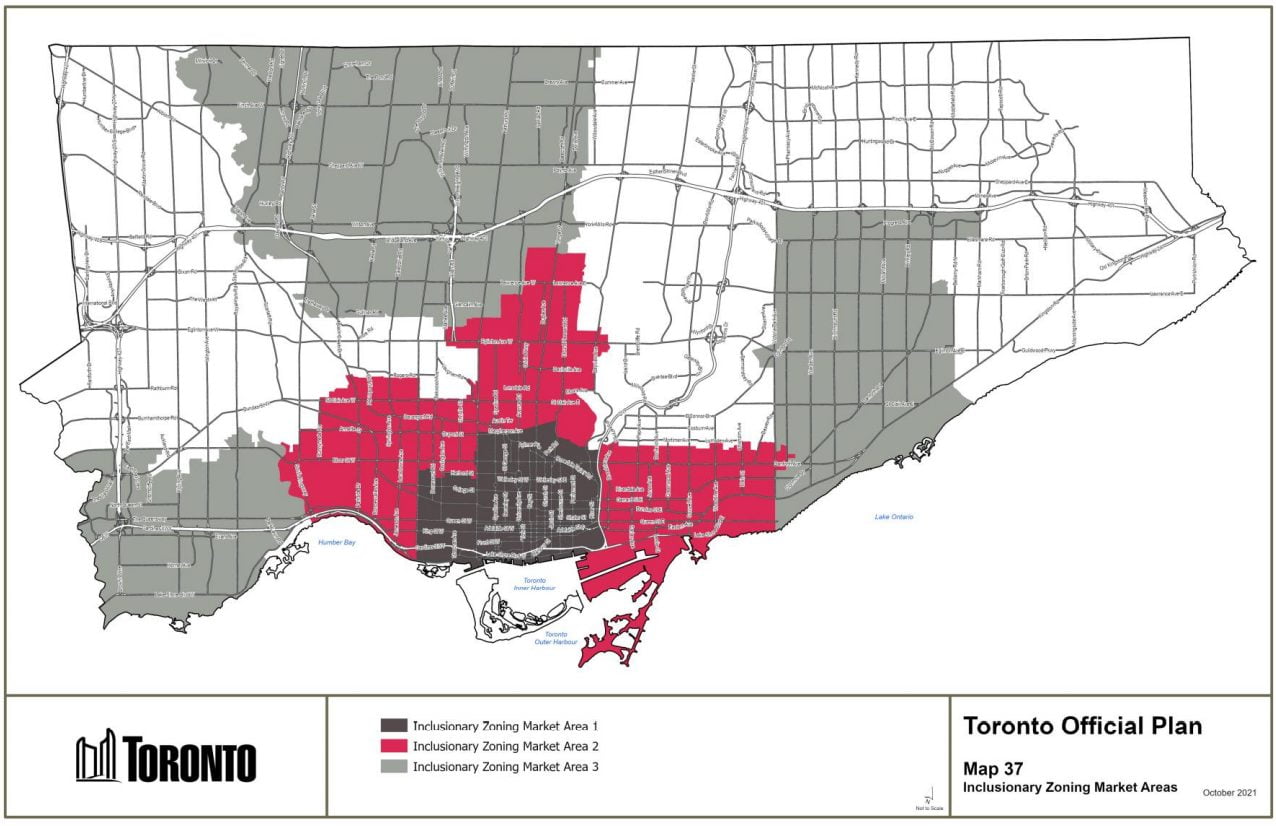

The City has established three Inclusionary Zoning Market Areas (as pictured below). These areas have the highest amount of new housing supply with significant price escalation where the City has determined that its inclusionary zoning requirements should not affect overall development viability. The three areas are subject to different inclusionary zoning requirements based on their individual market conditions.

Image: City of Toronto By-Law 940-2021

The requirement for future condominium developments is broken down as follows:

Image: Aird Berlis

Toronto’s Inclusionary Zoning framework ensures affordability is maintained for 99 years, and that the by-law requirements be incorporated on a steady basis. The policy will be closely examined and reviewed after one year to allow for any changes that may be required to ensure market stability and the continued production of affordable housing units.

The resulting Inclusionary Zoning framework will help the City of Toronto reach the HousingTO Action Plan target of approving 4,000 new affordable ownership homes and 40,000 affordable rental homes by the year 2030.

Do you have any questions about inclusionary zoning in the City of Toronto? Connect with BAZIS on social media (Facebook, Twitter or Instagram) and let us know!

BAZIS is a Toronto real estate development company specialized in new construction condos for sale and pre-construction condos in Downtown Toronto. We are committed to excellence in every facet of the commercial and residential real estate development process. Combining visionary architecture, design, marketing and construction with the epitome of corporate integrity and environmental responsibility, BAZIS has become a major force in articulating Toronto’s ever-evolving skyline.

5 Things to Know About Buying a Pre-Construction Condo

Buying a pre-construction condo is incredibly exciting. It gives buyers the chance to live in a brand new home that has never been lived in before, so it’s completely fresh and clean. Pre-construction condos can be customized to suit homeowners’ personal style, from the floor plan and layout to the flooring and cabinetry. Plus, it’s thrilling to watch your new home come to life before your eyes.

However, it’s easy to get caught off guard with the financing of a pre-construction home. To make the process a little bit easier, we’re breaking down the financial process and explaining what you need to know about deposit structure, the cooling-off period, occupancy fees, and closing costs. Costs vary depending on the value of the home, municipality, and the builder, so read on to learn more.

Deposit Structure

The down payment for resale condos can be as little as 5%, however pre-construction condos typically require 20%. The good news is that it gets paid in installments, giving the buyer more time to save up. A typical deposit structure is $5,000 with the offer, and then 5% increments at 30 days, 90 days, 180 days, and at final occupancy. The exact timing depends on the builder, and some developers even offer pre-launch deposit structures that are even more manageable, for example, your deposit may be split over 365 days instead of 180. Deposits often tend to be higher at the beginning of a project as banks and lenders require this, however deposit structures may become more flexible closer to completion, where a builder may be willing to negotiate your fee structure.

Cooling-Off Period

After putting down a deposit on a pre-construction condo, buyers are given a “cooling-off period.” During this time the buyer has some time to re-evaluate their purchase decision. Typically, the cooling-off period is 10 days in Ontario, so this would apply for all Toronto condos. At this time, the buyer should organize their finances and ensure they’re ready to move forward with the purchase. They should also take advantage of this time to review their Agreement of Purchase and Sale with a real estate lawyer to make sure they fully understand the builder clauses. If a buyer changes their mind during the 10-day cooling-off period, they are able to back out of the contract and have the deposit returned without deduction.

Occupancy Fees

After the condo is built and the buyer’s unit becomes available to move into, there is a period called interim occupancy. During this period, which can last a few weeks to several months, the buyer can take possession of their unit without actually owning it. This is because titles can’t be transferred until the whole building is complete. During this time, rather than paying their mortgage, the buyer will pay occupancy fees. The occupancy fee is made up of three parts: interest (usually 1%) on the unpaid balance of the purchase price of the condo, an estimate on the municipal taxes for the unit, and a projected common expense contribution to keep the building running. The fee is usually charged monthly. Many buyers will elect to take advantage of the interim occupancy period, as the payment may be less than their rent, and to take advantage of moving into their unit. A downside is that the building’s amenities may not yet be available to use, however the buyer can begin leasing out their space if they choose to do so.

Closing Costs

Closing costs are additional costs that the buyer will need to pay between the time they make their offer and the day they close. These costs include home inspection fees, legal fees, land transfer taxes, etc. Buyers should try to put aside an additional 1.5% to 4% of the purchase price of their homes, in order to cover these closing costs. Additional closing costs include: development and educational levies, a New Home Warranty Plan enrolment fee, utility hook-up fees, assignment fees (if you sell before final closing) and occupancy fees. These additional costs are builder- and project-specific, and some may even be included in the sale price of the unit.

It’s also important to keep in mind that when buying a pre-construction condo, buyers will need to contribute at least two months of condo fees to the condo’s reserve fund. Pre-construction condos are also subject to HST, which builders often factor into the purchase price of the unit and pay on behalf of the buyer. If a buyer is planning to live in the unit, they may qualify for an HST rebate.

Timing

When it comes to pre-construction condos, delays happen – and it’s not uncommon. Builders are permitted two extensions that last up to 120 days each. After that period, the developer must set a new date, and buyers are eligible for delayed closing compensation. If another year passes, the buyer can cancel their agreement.

With so many fees and closing costs, it’s no surprise that many pre-construction condo buyers feel overwhelmed at closing time. However, with due diligence and sound legal advice, buyers can confidently navigate the challenge of home financing and attain the home of their dreams.

Do you have any questions about purchasing a pre-construction condo? Connect with BAZIS on social media (Facebook, Twitter or Instagram) and let us know!

Pre-Construction Condos: Investing in Downtown Toronto

In this week’s blog post, we’re delving into the details of pre-construction condos – especially condos built in downtown Toronto – and answering all of your questions about them. If you’ve been wondering if a pre-construction condo is a good idea for you, how to decide on pre-construction versus resale, or the investment benefits of choosing a pre-construction condo, read on!

What is a pre-construction condo?

A pre-construction condo is just that – a condo that has not been constructed yet.

What are the benefits of investing in a pre-construction condo?

-Investing in Toronto pre-construction condos is a fantastic investment. It’s a great way to get into the Toronto real estate market and build equity.

-You get the thrill of personalizing your home to your unique style, while having a brand new home that no one has lived in before.

-You can choose your unit on a first-come-first-served basis. You get to select the view, floor plan, and layout that suit your lifestyle.

-Unlike a resale condo, you don’t have to pay your down payment all at once. When investing in Toronto pre-construction condos, you pay off your down payment in stages over the first year. This gives you more time, flexibility, and control over your finances.

Why are pre-construction condos in Toronto a good investment?

-With rising home prices and shortages in the Greater Toronto Area, you can grow your money quickly if you invest in a pre-construction condo in Toronto. The value of a pre-construction condo increases the moment you take ownership (and even before then), and it generally continues to increase until you decide to sell. This is even truer if you invest in an up-and-coming neighbourhood.

-You get the lowest price possible. Builders and developers are looking to sell units to fund construction, so you get amazing value, and you can also avoid the stress of costly bidding wars.

-Pre-construction condos allow you to break into the real estate market at a slower pace, demand less money upfront, and give you the best appreciation value.

-Pre-construction condos offer better rental and resale value, because people would rather live in a new build rather than invest in properties that need maintenance or extensive renovations, or that have outdated features and finishes.

-The Toronto real estate market is hot right now and you can’t beat the location. Living in downtown Toronto gives you the advantage of being in close proximity to the best jobs, top universities, and all the entertainment options you can dream of. If you decide to sell your condo later on, you’ll have no difficulty finding someone who wants to live in downtown Toronto.

Who should consider investing in a pre-construction condo?

-Anyone and everyone! Pre-construction condos in Toronto are a great investment for young professionals, downsizers, and even families. Many condominiums offer 2-3+ bedrooms, and incredible amenities to suit all lifestyles.

Our upcoming Queen Church condo with Tridel, for example, is located in the heart of downtown Toronto. It’s perfectly situated nearby the Financial District, the University Health Network, the top universities and colleges in the city, and the best in entertainment. Queen Church also offers luxurious amenities that make life simpler and more enjoyable, including a state-of-the-art fitness centre, a pet run, BBQ and fireplace lounge, and much, much more.

Are you considering investing in a pre-construction condo? Are you interested in learning more about Queen Church? Connect with BAZIS on social media (Facebook, Twitter or Instagram) and let us know!